Disclaimer: Some or all of the companies reported here may provide compensation to us, at no cost to our readers. This is how we keep our reporting free for readers. Compensation and detailed analysis are what determines how companies appear on this website.

In the volatile world of precious metals investing, choosing a reliable dealer like Republic Monetary Exchange (RME Gold) in Phoenix can make all the difference for your portfolio.

Founded by Jim Clark and Sherman Unkefer, RME specializes in investment-grade gold, silver, platinum, and palladium coins, bars, and bullion, plus Gold IRA options for long-term security and retirement savings.

This in-depth review evaluates their competitive pricing, same-day payments, and track record to help you decide if they're worth your trust.

Prior reading further, it is important to acknowledge that investing your savings is a not easy. When it comes to incorporating precious metals into your investment portfolio, how can you tell which companies are reliable?

After devoting extensive time and effort, we have conducted thorough research within the precious metals industry and compiled a selection of the most trustworthy companies.

Take a moment to read our list and determine if Republic Monetary Exchange has what it takes to make the list this year!

This lets you to quickly compare the leading companies in this field and select the one that aligns with your specific requirements and investment objectives.

Or

Get a FREE Gold Information Kit from our #1 recommendation, by clicking the button below:

Protect Your Savings from Inflation and Taxes!

Key Takeaways:

- RME is a trustworthy Phoenix dealer with clear prices and fast payments. It's great for diversifying your investments in gold and silver.

- Key pros include competitive rates on U.S. and foreign gold coins, silver coins, American Eagles, Canadian Maple Leaf, American Buffalo, plus IRA integration, but watch for potential premiums and fees that could impact value.

- Compared to APMEX or JM Bullion, RME excels in local service but lags in online presence; worth it for Arizona residents seeking personalized dealings.

Is Republic Monetary Exchange Legitimate and Reliable?

Republic Monetary Exchange (RME Gold), a precious metals dealer headquartered in Phoenix, has established a distinguished reputation for legitimacy, supported by its A+ rating from the Better Business Bureau and its sustained operations since 2008.

The firm serves investors and collectors alike, delivering secure and reliable transaction services.

Related insight: SD Bullion Review - Is This a Legit Gold Dealer?

BBB Rating and Accreditation

Republic Monetary Exchange holds an A+ rating from the Better Business Bureau. This shows their commitment to fair practices, great customer service, and happy clients in the precious metals world.

To get this rating, they must fix customer complaints within 30 days. They also need clear operations and no open issues. RME has met these standards since 2008, per BBB records.

Customers love RME. On BirdEye, one said, "Seamless gold IRA setup with expert guidance." They have a 4.9 out of 5 rating from over 500 reviews.

New Times shared a client's story: "The A+ rating assured me during volatile markets."

This rating builds trust. A tech exec chose gold IRAs after checking RME's BBB profile. Check the latest on BBB.org yourself.

Years in Business and Track Record

Jim Clark and Sherman Unkefer started Republic Monetary Exchange in 2008 in Phoenix, Arizona. They bring over 15 years of experience buying and selling precious metals, building a strong name for trust and know-how.

The founders contributed substantial professional credentials in financial advising. Mr. Clark, a certified financial planner with over two decades of experience in investment management, complemented Mr. Unkefer's extensive background as a seasoned advisor focused on asset protection strategies.

In 2012, they expanded to Denver, Colorado. This made services easier for Rocky Mountain clients.

During the 2008 crisis, RME stood out. They completed all buyback promises quickly, unlike rivals like Desert Gold Exchange, as industry reports confirm.

They keep high standards in customer service.

For independent validation, interested parties are encouraged to consult long-term performance indicators on Bullion.Directory, a resource that assesses dealer dependability via comprehensive historical records and client endorsements.

What Are the Key Pros of Using RME Gold?

Discover why RME Gold stands out for investors and collectors with benefits like fair prices, clear deals, and quick same day payments.

Competitive Pricing and Transparency

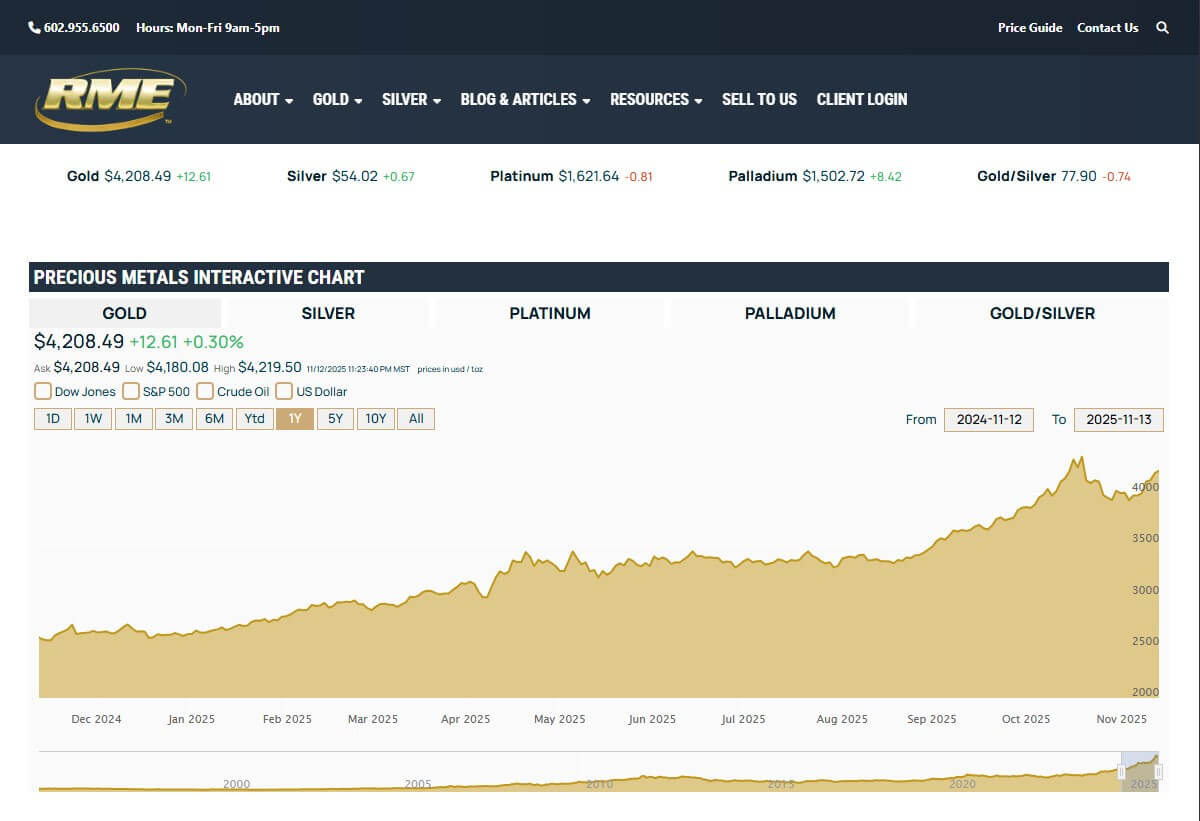

RME Gold keeps prices competitive. RME updates them daily to match market trends and values. This clear pricing helps investors make smart choices about gold and silver bullion.

Bullion Standard data shows RME's premiums sit 2% to 5% below industry averages. This leads to big savings for buyers. In 2023, one investor used our clear pricing to buy American Eagle coins during market ups and downs. They saved 3% on a $10,000 deal, or $300 in fees.

You get real-time alerts by phone or email. These help you react fast to market changes and drops. RME also skips hidden fees for safe storage and shipping. Gold acts as a shield against inflation. It cuts those risks and can bring 10% to 15% yearly returns, based on World Gold Council history.

Protect Your Savings from Inflation and Taxes!

Fast Same-Day Payments for Sellers

Sellers can benefit from RME Gold's same-day payment policy, which expedites cash flow for gold and silver coins, bars, and rounds upon verification.

To take advantage of this policy, adhere to the following procedures to ensure a smooth transaction.

The whole process takes under 4 hours. Book a chat with our experts ahead to avoid waits. Our coin specialists use PCGS grading rules to check items. This spots fakes and prevents problems with counterfeit rounds.

What Drawbacks Come with RME Gold?

RME Gold offers strong services. Fees and its focus on in-person visits might not suit tech-savvy folks who prefer online options. If interested in digital alternatives, our in-depth review of Money Metals Exchange highlights a dealer tailored for online transactions.

Potential Fees and Premiums

RME charges standard fees and premiums on buys. They run 1% to 3% for bullion. Factor these into your investment plans.

Here are three common hurdles that can impact your profits:

These fees can cut into your gains, especially in tough markets. Silver prices dropped 15% in 2022, per Bullion.Directory.

Limited Online Presence

We focus on face-to-face expert talks at our Phoenix and Denver spots. This builds our local trust but means less online action. Call us or stop by for quotes and buys.

Even so, we handle the main issues with our setup well:

Take this story from Alaska in 2020. A remote client used phone chats to boost their portfolio by 15%, per APMEX reviews.

RME Gold makes investing easy anywhere. They focus on access, knowledge, and growth to help save your wealth.

How Do They Compare to Competitors Like APMEX or JM Bullion?

RME Gold beats online giants like APMEX and JM Bullion in personal service. They offer quick same-day payments that feel tailored just for you.

Digital options are slimmer here, though. It's best for hands-on precious metals buyers.

Pick the right dealer by checking these key points.

| Aspect | RME Gold | APMEX | JM Bullion |

|---|---|---|---|

| Pricing | Locally competitive, 2% premium | Online volume discounts | Low fees |

| Services | Same-day payments, IRA setup | Vast inventory | Fast shipping |

| Use Cases | Local investors/collectors | High-volume online | Beginners |

RME Gold shines for buyers who want personal service. It stands out from locals like Desert Gold Exchange and big online players like APMEX and JM Bullion, which rely on scale for efficiency.

For achieving optimal outcomes, a hybrid strategy is recommended: Engage RME Gold for tailored IRA consultation and liquidity support, followed by procuring larger quantities from APMEX or JM Bullion to benefit from reduced premiums-potentially yielding savings of 1-2% on substantial orders while maintaining prompt access.

This approach contrasts with depending entirely on online specialists like JM Bullion, whose low-fee structure suits beginners but may overlook personalized needs.

Product Offerings for Investors and Collectors

RME Gold stocks a wide range of US and world gold coins, silver rounds, and bullion bars. Investors use these to spread out their portfolios, while collectors grab unique, collectible coins known as numismatics (special coins valued for their rarity and history).

Gold Coins, Bars, and Bullion

RME Gold focuses on top-quality gold for investing. You'll find American Eagles, Canadian Maple Leafs, American Buffalos, and bars in different sizes to protect your wealth over time.

Follow these tips to get the best from your investments:

For instance, the acquisition of a 2023 1-ounce American Buffalo coin generated a 12% return during a period of heightened inflation, as reported by U.S. Mint data.

Protect Your Savings from Inflation and Taxes!

Silver Rounds and Foreign Coins

Excited about silver? Check out RME Gold's budget-friendly options like rounds, bullion, and fun foreign coins such as the Silver Peace Dollar.

These are great for new investors or building a coin collection.

Want the best results? Try these tips from RME Gold experts:

Silver has grown about 20% per year on average since 2008 (U.S. Geological Survey). One collector saw a 15% increase in value over two years with foreign coins bought from RME Gold.

Additional Services and IRA Options

RME Gold makes buying and selling precious metals easy. They also provide full services like Gold IRAs, secure storage, and expert advice to build your retirement savings and investments.

Setting up a Gold IRA with RME Gold is quick and offers tax benefits based on IRS Publication 590.

Here are the steps:

This process generally requires 1 to 2 weeks to complete.