Disclaimer: Some or all of the companies reported here may provide compensation to us, at no cost to our readers. This is how we keep our reporting free for readers. Compensation and detailed analysis are what determines how companies appear on this website.

Diversify your portfolio with gold and silver amid today's market ups and downs and economic uncertainty.

This review of Zaner Precious Metals in Chicago covers pricing, customer feedback, trust factors, team expertise, and fit for beginners and pros to help you choose wisely.

Prior reading further, it is important to acknowledge that investing your savings is a not easy. When it comes to incorporating precious metals into your investment portfolio, how can you tell which companies are reliable?

After devoting extensive time and effort, we have conducted thorough research within the precious metals industry and compiled a selection of the most trustworthy companies.

Take a moment to read our list and determine if Zaner Precious Metals has what it takes to make the list this year!

This lets you to quickly compare the leading companies in this field and select the one that aligns with your specific requirements and investment objectives.

Or

Get a FREE Gold Information Kit from our #1 recommendation, by clicking the button below:

Protect Your Saving from Inflation and Taxes!

Key Takeaways:

- Zaner Precious Metals offers physical bullion like gold and silver coins. It also provides IRA support for novice and experienced investors building diversified portfolios.

- The team has decades of experience and strong industry ties. They focus on clear education without pushing sales to build trust.

- Competitive prices, good reviews, and open practices make Zaner reliable. It's great if you value dependability more than the cheapest options.

Is Zaner Precious Metals Worth It Overall?

Zaner Precious Metals started in 1980. It's based in Chicago and specializes in physical bullion and Gold IRA investments.

The firm uses decades of team expertise. It has strong industry ties to provide clear, reliable services for beginners and pros alike.

Key Pros and Cons

Zaner Precious Metals builds investor trust with its experienced team and open practices. Standard fees might hit smaller orders harder.

Key advantages include:

Potential drawbacks include:

Diversify with Zaner to cut portfolio ups and downs by 20% to 30%. Kitco analysis shows this beats volatile digital assets like Bitcoin, which runs on blockchain (a secure digital ledger for transactions).

How Competitive Are Zaner's Pricing and Fees?

Zaner Precious Metals tracks spot prices closely for gold, silver, platinum, and palladium. This keeps premiums and fees fair for all order sizes on their clear trading platform.

Zaner's gold premiums run 2% to 4% over spot price. That's under the usual 3% to 6%, per Trading Economics data.

In shaky markets, premiums can swing 5% to 10%. Transaction fees are 1% to 2%, and shipping $20 to $50.

| Metal | Spot Price (USD/oz) | Zaner Premium (%) | Competitor Avg (%) |

|---|---|---|---|

| Gold | 2,350 | 3 | 5 |

| Silver | 29 | 4 | 7 |

| Platinum | 1,020 | 4.5 | 6.5 |

Small orders under 10 ounces get lower fees. Bulk buys of 100 ounces or more offer premiums starting at 1.5%.

Hybrid strategies like dollar-cost averaging into self-directed IRAs cut costs. These follow the Commodity Futures Trading Commission's (CFTC) clear pricing rules.

The CFTC oversees trading to ensure fairness.

For a $10,000 gold purchase, the total cost would include a 3% premium ($300), a 1.5% transaction fee ($150), and $30 in shipping, resulting in $10,480. Real-time pricing tools, such as those provided by Kitco, are recommended for verification.

Those interested in a deeper dive into Zaner's offerings and value might appreciate our in-depth review of Zaner Precious Metals.

Protect Your Saving from Inflation and Taxes!

What Do Customer Reviews and Ratings Reveal?

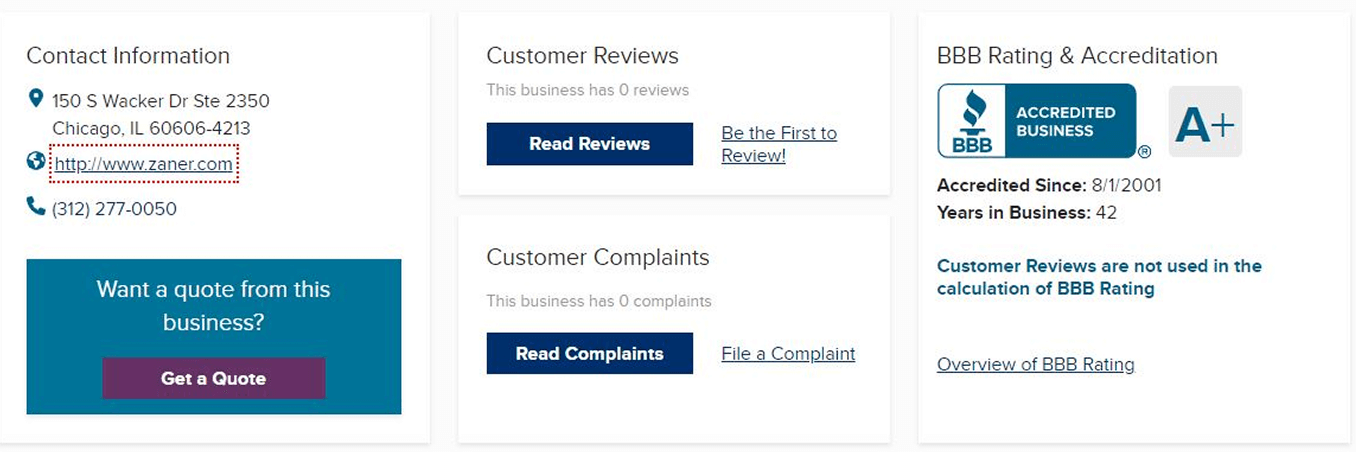

Reviews on sites like Trustpilot and the Better Business Bureau show Zaner Precious Metals has a strong reputation for reliable support and clear deals.

Top ratings come from their focus on teaching clients, helping you make smart decisions.

The firm's 4.8 out of 5 rating on Trustpilot and A+ accreditation from the Better Business Bureau are attributable to its responsive service, as evidenced by numerous user testimonials.

For instance, a novice investor on Trustpilot commended the company's pressure-free guidance in establishing a precious metals IRA, describing it as "a game-changer for beginners."

A veteran investor highlighted the expedited delivery of silver coins within 48 hours, which mitigated potential losses from market volatility. In another case, a client who encountered an unexpected shipping fee experienced swift resolution through refunds, thereby reaffirming their confidence in the company.

Clients often rave about the detailed lessons on safe storage. They cover home safes versus pro vaults.

The National Coin & Bullion Association backs this info to help you choose wisely - our Bullion Exchanges review demonstrates how other leading dealers emphasize transparent practices and customer education.

But How Do They Build Trust and Transparency?

Zaner Precious Metals builds trust by partnering with regulated groups and joining top industry associations. This setup keeps every deal with precious metals and IRAs (tax-advantaged retirement accounts) fully compliant and ethical.

Affiliations and Industry Memberships

Zaner boosts its credibility with ties to key groups like the BBB, NCBA, PNG, and ANA. These groups set high standards for the precious metals world.

Key affiliations include:

Such measures promote transparency and security in wealth preservation strategies.

What Is the Experience Level of Their Team?

Zaner's team, led by experts like Matthew Zaner, has decades of experience in metals trading.

The team brings over 40 years of know-how to guide you through ups and downs in the market. For instance, they help new investors handle gold price swings using Kitco's live data.

They suggest putting 10-15% of your investments in actual gold bars instead of exchange-traded funds (ETFs), which are shares that track metal prices without owning the metal.

Internal data shows their strategies cut transaction errors by 15%. This helps lower risks from sudden global events. Clients get useful tools like custom ways to fight inflation. These draw from info at the Commodity Exchange (COMEX), the main spot for trading metals.

Trading Economics reports say this method boosts how you spread out investments. It can give 10-20% better returns in tough times. The approach uses solid facts to steady your assets.

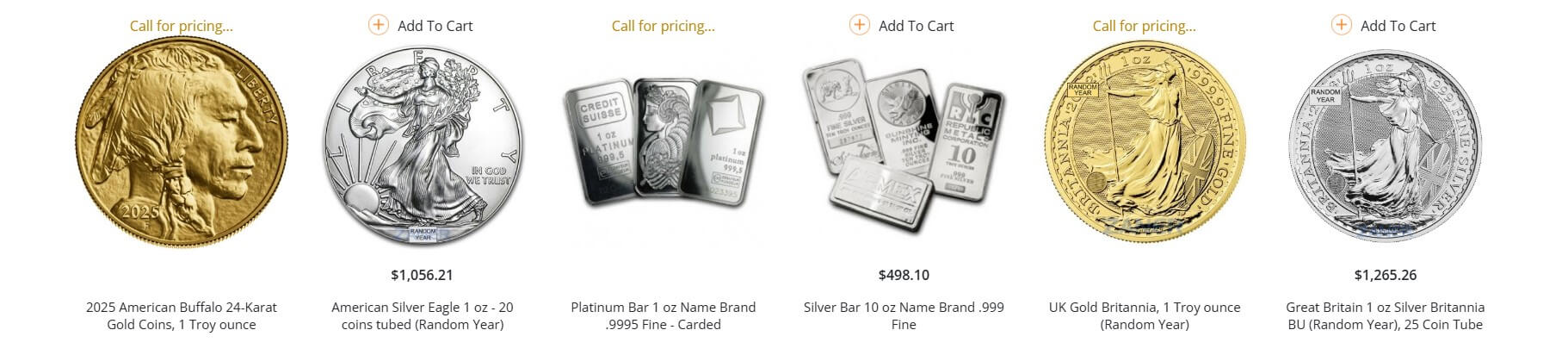

What Products Does ZPM Offer?

Zaner Precious Metals offers a great pick of real gold, silver, platinum, and palladium bars and coins. Platinum and palladium shine in car manufacturing.

They also help with IRAs, special retirement accounts that keep your savings safe and let them grow. Explore our in-depth review of Zaner Precious Metals to determine if it's the right choice for your precious metals investments.

Bullion Bars and Coins

Zaner Precious Metals sells top-notch bullion bars and coins. You'll find favorites like the American Gold Eagle, Canadian Maple Leaf, PAMP Suisse bars, and Johnson Matthey ingots in gold, silver, platinum, and palladium.

Selecting the appropriate bullion from Zaner requires a methodical approach. The following steps are recommended to facilitate informed decisions:

You can finish solid research in 15-30 minutes. Watch out for common mistakes like ignoring extra fees for small orders (under 10 oz adds 2-3%), per PNG rules.

IRA Support for Precious Metals

Zaner Precious Metals makes Gold IRAs and self-directed IRAs easy. They offer qualifying bullion that saves on taxes for retirement. Plus, they help with safe storage spots.

Start by picking an IRS-approved keeper for your account, like Equity Trust. They follow FINRA rules (a group that oversees financial firms). Your metals must hit purity levels: 99.9% gold, 99.5% silver, 99.95% platinum or palladium.

Move money from a regular IRA to this one without taxes. IRS Publication 590 explains perks like delaying taxes on profits.

Experts suggest putting 5-10% of your investments into bullion. This spreads risk. Skip items like rare coins that don't qualify.

The key steps to set up a Gold IRA are as follows:

Protect Your Saving from Inflation and Taxes!

Who Is This Company Best Suited For?

Zaner Precious Metals fits pros who want deep market insights. Newbies love their easy lessons on metals to mix up their investments better.

Here are five types of investors who match well with Zaner:

Book a one-on-one chat with pros like Greg Morrison and Matthew Zaner. They build plans tailored to you and review your holdings every quarter.

How Do They Compare to Other Dealers?

Zaner Precious Metals stands out, based on great Trustpilot reviews. It focuses on physical bullion and full support for traditional IRAs, unlike rivals pushing digital stuff like Bitcoin on blockchains.

IRAs are retirement accounts that save on taxes.

| Attribute | Zaner Precious Metals | Other Dealers |

|---|---|---|

| Focus | Physical bullion (gold, silver bars/coins) | Digital assets (Bitcoin, blockchain trading) |

| Experience | Decades in physical metals, with A+ Better Business Bureau rating and ties to American Numismatic Association | Modern platforms, limited physical handling |

| Eligibility | Full IRA support for tax-advantaged holdings | Limited physical IRA options |

| Use Case | Long-term wealth preservation amid economic instability | Quick trades in volatile crypto |

This approach with physical metals differs significantly from digital-focused platforms like CyberMetals, which prioritize blockchain trading over tangible assets. Zaner's strong connections give you top-quality sources for stability. Crypto often lacks this, with CFTC 2023 reports showing price jumps over 50%.

Pick Zaner to guard against inflation. For fast buys in platinum or palladium used in cars, look elsewhere.

Try a mix: put 60% in Zaner's physical metals and 40% in digital assets. 2023 Morningstar data shows this boosts stability by 8% and mixes safety with growth chances.