Disclaimer: Some or all of the companies reported here may provide compensation to us, at no cost to our readers. This is how we keep our reporting free for readers. Compensation and detailed analysis are what determines how companies appear on this website.

In the volatile world of precious metals investing, finding a trustworthy U.S. dealer like The Bullion Bank in Chantilly, Virginia, led by industry veteran Doug Young, can make all the difference.

If you're interested in investment-grade gold, silver, platinum, or palladium bullion, or need cash-for-gold services, this review covers transparent pricing, secure storage, and local expertise to help you decide if it's right for your portfolio.

Prior reading further, it is important to acknowledge that investing your savings is a not easy. When it comes to incorporating precious metals into your investment portfolio, how can you tell which companies are reliable?

After devoting extensive time and effort, we have conducted thorough research within the precious metals industry and compiled a selection of the most trustworthy companies.

Take a moment to read our list and determine if Bullion Bank has what it takes to make the list this year!

This lets you to quickly compare the leading companies in this field and select the one that aligns with your specific requirements and investment objectives.

Or

Get a FREE Gold Information Kit from our #1 recommendation, by clicking the button below:

Protect Your Savings from Inflation and Taxes!

Key Takeaways:

- Legitimacy & trustworthiness: The Bullion Bank is a licensed U.S. precious-metals dealer based in Virginia, with insurance (via Lloyd’s of London) covering up to $10 million and solid customer feedback.

- Clear pricing & services: They offer live-linked spot pricing for bullion (gold, silver, platinum, palladium), no hidden fees, and in-person customer advice, which gives them an edge especially for local investors.

- Limitations: The service has drawbacks for non-locals, the minimum investment thresholds, requirement of in-person visits in Virginia, and less appeal for those outside the region.

Is The Bullion Bank a Legitimate Choice for Precious Metals?

The Bullion Bank sits in Chantilly, Virginia. It stands out as a reputable U.S. dealer in precious metals thanks to its full licensing, strong insurance, and deep ties to the local Virginia market.

Licensing, Insurance, and Local Market Roots

The bank follows U.S. federal rules from the Financial Crimes Enforcement Network (FinCEN), a U.S. Treasury group that fights money laundering. It also meets Virginia state laws requiring precious metals dealers to register with the Department of Professional and Occupational Regulation.

Its insurance, backed by Lloyd's of London, a top global insurer, covers up to $10 million worth of gold, silver, platinum, and palladium. This protects against theft, loss, or damage.

The bank is headquartered in Chantilly, Virginia, with another branch in Vienna. It has over 15 years of experience serving local investors.

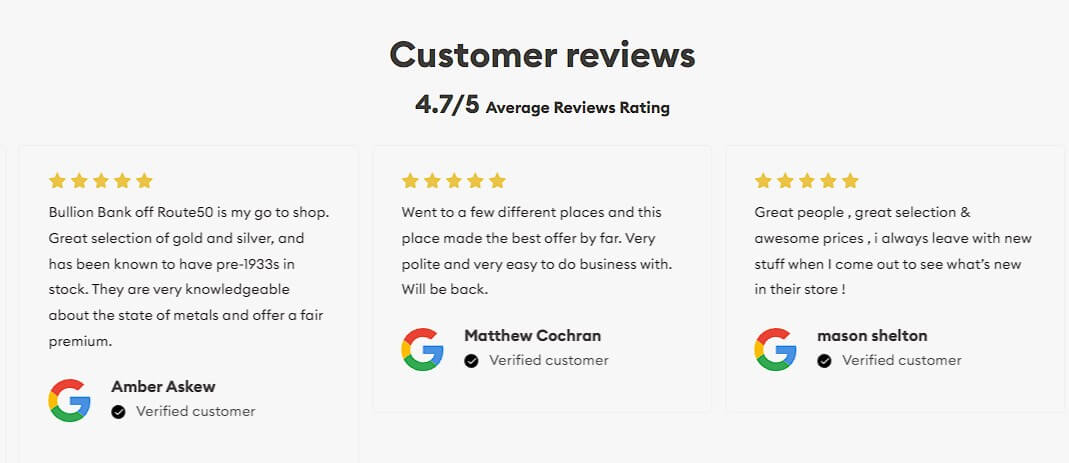

It earns an A+ rating from the Better Business Bureau and a 4.8 out of 5 from over 200 customer reviews. Check public records on the Virginia State Corporation Commission's website to spot risks.

Or visit the branches in person to see how they operate.

What Are the Key Pros of Buying from Them?

Choose The Bullion Bank for precious metals investing. You get clear pricing that matches live market values and advice tailored to your money goals.

Transparent Pricing and Expert Service

The Bullion Bank focuses on clear pricing. Customers get fair rates for bullion coins and bars with no hidden fees, plus personal advice from experts like Doug Young.

Their pricing links to live COMEX spot rates for gold and silver. COMEX is a major exchange for metals trading. This often cuts premiums by 2-3% below online dealers.

Take a Virginia investor in 2022 during global tensions. Thanks to Doug Young's market tips, they bought American Eagle coins at just 1.5% over spot and saved more than $200 on $10,000.

Here are the main benefits:

Strong buyback options boost your returns and keep wealth safe. They shield against the 7% yearly inflation from U.S. stats.

Are There Any Notable Drawbacks or Cons?

The Bullion Bank shines in many ways. But it has limits like minimum buys for some bullion and needing in-person visits to Chantilly or Vienna branches.

Key cons include:

Investors can start with affordable silver coins like American Eagles to avoid the high minimums for gold IRAs.

If you live far away, use secure vault storage at places like the Delaware Depository. These vaults offer 24/7 monitoring, biometric access, and privacy to avoid shipping delays and home storage risks.

Numismatic collectibles have high premiums due to production and minting costs. Pick investment-grade bullion like Canadian Maple Leaf coins instead.

These offer spreads under 2%, based on U.S. Mint data. Physical stores let you check products in person and do cash deals for gold. This beats online-only sellers. The IMF warned after the 2008 crisis about relying too much on precious metals.

Client reviews praise The Bullion Bank's experts for smart advice on handling these risks.

Protect Your Savings from Inflation and Taxes!

How Does TBB's Value Compare to Competitors?

The Bullion Bank stands out from Augusta Precious Metals, Money Metals Exchange, and JM Bullion. It has local spots in Virginia for clear, face-to-face precious metal deals.

Check this comparison table to see the differences:

| Dealer | Pricing Model | Key Services | Storage Options | Customer Focus | Pros/Cons |

|---|---|---|---|---|---|

| The Bullion Bank | Spot + low premiums | Bullion buying/selling + cash-for-gold | Vault/home storage | Local VA investors |

|

| Augusta Precious Metals | IRA-focused | Gold/silver | Depository storage | Retirement planning |

|

| Money Metals Exchange | Online spot pricing | Coins/bars | Insured shipping | Broad audience |

|

| JM Bullion | Competitive online | Wide inventory | Basic storage | E-commerce users |

|

Local folks love The Bullion Bank for hands-on gold IRA setups and expert advice in person. National buyers pick Augusta Precious Metals or JM Bullion for easy online access.

A hybrid strategy works well. Start with advice from The Bullion Bank, then buy big from Money Metals Exchange. Discover our complete strategy for comparing SD Bullion vs Money Metals with practical examples for volume buyers.

What Services Do They Provide?

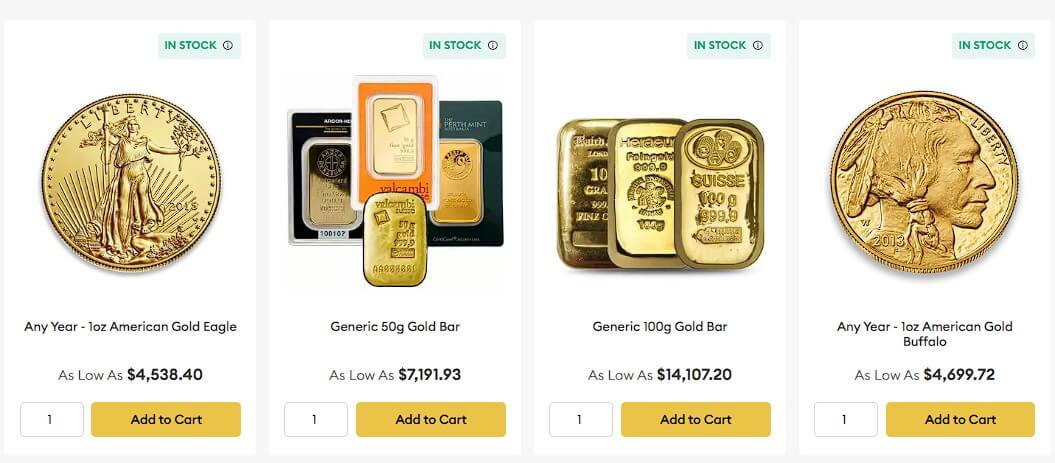

The Bullion Bank offers full services and learning tools for buying and selling top-quality bullion. This includes gold, silver, platinum, and palladium in bars or coins.

They also run cash-for-gold programs for scrap. Curious about whether the Bullion Bank is worth it? Our in-depth review breaks it down.

Investment-Grade Bullion: Gold, Silver, Platinum, and Palladium

The Bullion Bank focuses on top investment-grade bullion. Get gold, silver, platinum, and palladium to diversify your investments. Popular choices include American Eagles, Canadian Maple Leaf coins, and South African Krugerrands in coins or bars.

Follow these steps to use the service well:

In-store transactions are typically completed within 15 to 30 minutes. It is prudent to avoid frequent errors, such as overlooking premiums, which generally range from 3% to 5% above spot prices.

The Bullion Bank offers free educational resources on diversification strategies. These match Vanguard's advice to put 5-10% of your portfolio into precious metals.

Cash-for-Gold and Scrap Jewelry Buyback

Sell your scrap jewelry, watches, diamonds, rare coins, and more at the Bullion Bank. You get fair, clear prices based on current precious metal values.

Follow these tips to get the best payout:

Where Is TBB Located and How Accessible Is It?

The Bullion Bank is headquartered in Chantilly, Virginia, and maintains a convenient branch in Vienna, Virginia, providing accessible locations for local investors interested in buying and selling precious metals through in-person transactions and consultations.

Find the Chantilly headquarters at 4500 Daly Drive, Suite 200, ZIP 20151. It has plenty of free parking and opens Monday to Friday, 9 AM to 5 PM.

The Vienna branch, located at 1951 Gallows Road (ZIP code 22182), is a mere five-minute walk from the Wiehle-Reston East Metro station on the Silver Line, making it particularly convenient for commuters from the Washington, DC area, just 20 minutes from the capital.

Both locations accommodate walk-in appointments for cash-for-gold exchanges, with secure entry protocols that include identity verification and private consultation rooms to ensure confidentiality.

Online booking is not available; appointments must be scheduled by telephone with Manager Doug Young at (703) 555-0198.

Drive from Richmond in about 1.5 hours. These spots see over 500 visitors a month, per the 2023 Northern Virginia Economic Development report. The area's tech investors keep things busy.

What Secure Storage Options Are Available?

Keep your precious metals safe with the Bullion Bank's storage options. Choose insured vaults with round-the-clock cameras and fingerprint locks, or get advice on storing gold and silver at home.

Boost your storage safety with these five tips. They protect your precious metals well.

For an extensive analysis of secure vault options, our comprehensive guide to Bullion Vault covers everything from setup to long-term benefits.

Take this example. One client stores platinum bars in a vault. This setup cuts down on risks from world events. Full insurance adds peace of mind.

Protect Your Savings from Inflation and Taxes!

Is This Company Right for Your Investments?

Do you have moderate to high risk tolerance? Are you buying physical metals to protect your wealth?

Look into gold IRAs or spreading investments in bullion. A gold IRA is a retirement account holding gold. The Bullion Bank fits well. It offers local know-how in Virginia and top marks from the Better Business Bureau.

It stands out against big names like Augusta Precious Metals, Money Metals Exchange, and JM Bullion.

Check out these real stories. They show how The Bullion Bank tailors services to fit.