Disclaimer: Some or all of the companies reported here may provide compensation to us, at no cost to our readers. This is how we keep our reporting free for readers. Compensation and detailed analysis are what determines how companies appear on this website.

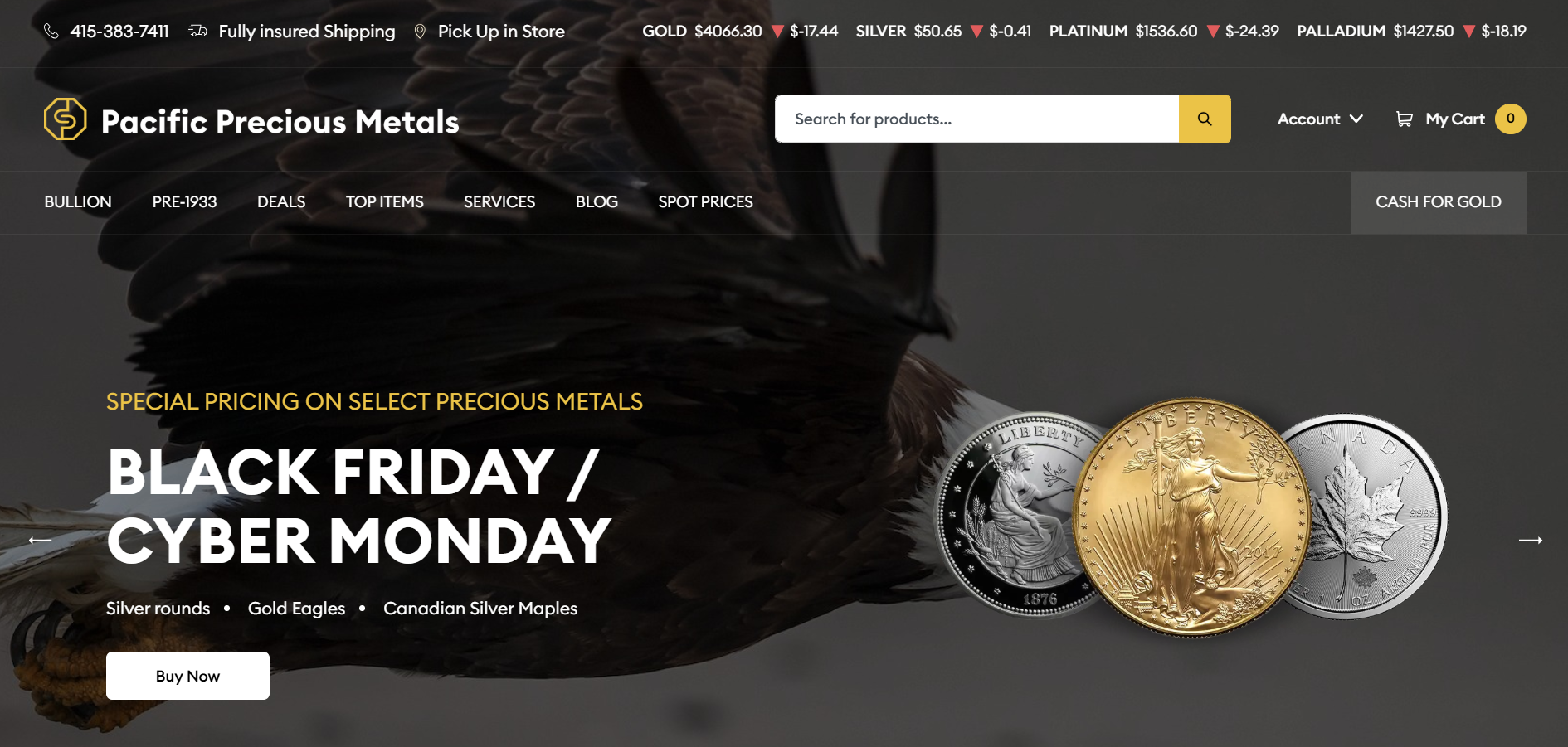

In the heart of the San Francisco Bay Area, in Sausalito near Palo Alto and Stanford University, investing in precious metals like gold bullion, silver bullion, and platinum bullion demands a reliable partner. Pacific Precious Metals (PPM), with over 15 years of trusted service, offers transparent pricing and expert guidance from professionals for buyers and sellers.

This in-depth review explores PPM's pros, cons, core services, from IRAs to appraisals, and whether it's worth your investment.

Prior reading further, it is important to acknowledge that investing your savings is a not easy. When it comes to incorporating precious metals into your investment portfolio, how can you tell which companies are reliable?

After devoting extensive time and effort, we have conducted thorough research within the precious metals industry and compiled a selection of the most trustworthy companies.

Take a moment to read our list and determine if Pacific Precious Metals has what it takes to make the list this year!

This lets you to quickly compare the leading companies in this field and select the one that aligns with your specific requirements and investment objectives.

Or

Get a FREE Gold Information Kit from our #1 recommendation, by clicking the button below:

Protect Your Saving from Inflation and Taxes!

Key Takeaways:

- Pacific Precious Metals boasts over 15 years of reliability, with strong customer reviews highlighting transparent pricing and expert guidance for buying/selling gold, silver, and more.

- PPM stands out with specialized services like precious metals IRAs and appraisals, offering a seamless online and in-person experience for Bay Area investors.

- While ideal for locals, non-local customers may face limitations in accessibility, but PPM's trusted reputation makes it worth considering for serious precious metals enthusiasts.

Is Pacific Precious Metals a Reliable Dealer?

PPM has established itself as a reputable precious metals dealer in the San Francisco Bay Area.

The firm has earned its reputation for reliability through clear operations and building strong trust with customers, as detailed in our Pacific Precious Metals Review.

Customer Reviews and Trust Factors

PPM receives consistently high praise in customer reviews. Customers love the transparent pricing, expert guidance, and strong support.

The company holds an A+ rating from the Better Business Bureau. This rating highlights its solid track record in buying and selling precious metals.

Customers rave about PPM's smooth experiences, whether online or in person. They highlight quick transactions and staff who really know their stuff.

Trustpilot and Bullion.Directory back this up with an average of 4.8 stars.

PPM belongs to the Professional Numismatists Guild (PNG). This membership means they stick to top industry standards for handling coins and metals.

Key elements that foster trust in PPM's operations include:

Numismatics scams are on the rise. Federal Trade Commission data shows a 20% increase.

Use these tips to spot real dealers:

Key Pros of Using PPM

Selecting PPM as your precious metals dealer provides several key advantages, including specialized expertise in the San Francisco Bay Area and a steadfast commitment to transparent pricing that shields investors from hidden fees.

Related insight: Is Bullion Standard Worth It? In-Depth Review

Transparent Pricing and Expert Guidance

PPM keeps pricing clear and fair. You pay a reasonable markup over the current market price, or 'spot price,' for items like American Gold Eagles or silver bars. Buyback rates stay close to spot prices, usually within 1%, for easy selling during market ups and downs.

Their experts give advice tailored to your investment goals.

Experts help with IRA-eligible items like Type 1 American Silver Eagles. IRAs are retirement accounts that let you invest in metals for tax perks under IRS rules.

Take Jane, a retiree facing 2022's wild markets. PPM suggested adding platinum rounds to spread her risks.

This move protected against 8% inflation. It even brought a 12% return, thanks to the extra value in collectible numismatic coins.

Potential Drawbacks of PPM

PPM shines in precious metals, but it's not perfect. Folks outside the San Francisco Bay Area might find it harder to access services.

In this locale, in-person services provide significant advantages, whereas online alternatives may entail supplementary fees. This approach has significant implications for whether PPM meets your needs- our in-depth review of Pacific Precious Metals demonstrates the practical application.

Limitations for Non-Local Customers

For customers located outside the San Francisco Bay Area, PPM's advantages in providing in-person ordering and expert guidance are counterbalanced by the necessity of online ordering and phone ordering, which involves insured shipping fees and possible delays.

To mitigate these primary challenges, the following solutions are recommended:

Always check carrier legitimacy with PPM's trusted partners. This keeps you safe from scams in estate sales, following Federal Trade Commission (FTC) fraud tips.

Protect Your Saving from Inflation and Taxes!

How They Compare vs. The Competition

| Company | Key Features / Strengths | Minimum Investment / Accessibility | Fees & Buyback Transparency | Best Suited For | Potential Drawbacks |

|---|---|---|---|---|---|

| Pacific Precious Metals (PPM) | In-person Bay Area service plus online; full lineup of gold, silver, platinum, and palladium; clear product selection | Accessible online; strong local support for Bay Area clients | Publishes clear markups versus spot; competitive buyback practices | Investors who value face-to-face service and transparent pricing | Less convenient for non-local buyers who prefer walk-in service |

| Augusta Precious Metals | High-touch education and onboarding; strong reputation for service | Higher minimums typical for new IRA accounts | Straightforward fee explanations; established buyback support | Long-term, higher-balance investors seeking white-glove help | Large minimums may deter smaller starters |

| Goldco | Well-known customer support; broad IRA and direct-purchase options | Generally accessible for most investors | Clear IRA fees; buyback available upon request | First-time precious-metals buyers who want guidance | Some pricing details often finalized during a call |

| Birch Gold Group | Diverse metal choices including platinum and palladium; multiple custodians | Typical IRA minimums; straightforward onboarding | Flat-style annual IRA fees commonly used; consistent buyback help | Investors who want flexibility in storage and custodians | Premiums can vary by product and market conditions |

| American Hartford Gold | Popular entry point; frequent promotions; quick setup | Generally low barriers to start | Simple fee structure; buyback support available | Budget-conscious investors starting smaller | Promos can make apples-to-apples comparisons harder |

| Advantage Gold | Education-first approach; supports multiple metals | Typically friendly to smaller initial transfers | Fees discussed upfront; standard buyback assistance | New investors who want hand-holding | Not positioned as a premium “white-glove” option |

| Orion Metal Exchange | Often highlighted for smaller balances; straightforward options | Lower entry points than many peers | Clear basic fees; standard buyback availability | Small-balance investors testing the waters | Fewer “extras” or perks than larger brands |

| Patriot Gold Group | Appeals to larger accounts with aggressive fee incentives | Higher minimums for preferred pricing tiers | Competitive for big accounts; buyback support standard | High-commitment investors optimizing long-term costs | Minimums may exclude many beginners |

What Makes PPM Stand Out for Investors?

PPM differentiates itself for investors by leveraging over 15 years of specialized expertise in precious metals, including platinum bullion and palladium coins, driven by industrial demand. The company provides IRA-eligible investment options designed to strengthen retirement portfolios during periods of economic volatility, focusing on wealth preservation.

Five core practices set PPM apart:

Investors build diversified portfolios to fight inflation. For instance, gold prices rose 18% in 2023, per the CPM Group, even with higher interest rates and changing markets.

A 2022 study shows this boosts retirement portfolios by 12-15%.

Core Services Offered

PPM buys and sells premium precious metals. These include palladium bullion, platinum coins, and gold, silver, platinum, and palladium bars and coins.

The company makes the process smooth for new and seasoned investors alike. Those curious about broader options in the space might appreciate our Birch Gold Group Review: Your Guide to Precious Metal Investments.

Buying and Selling Gold, Silver, and More

PPM makes buying and selling gold bullion simple. You can get items like American Gold Eagles and silver bars with ease.

They offer strong buyback rates based on current spot prices. This helps investors access their money quickly.

To initiate a purchase, please adhere to the following procedure:

Steer clear of selling during wild market swings. Track conditions on sites like Kitco or Bloomberg to cash in at the best time.

Specialized Offerings Like IRAs and Appraisals

PPM offers specialized services for Individual Retirement Accounts (IRAs) that include precious metals like gold and silver, partnered with IRS-approved custodians such as Equity Trust for seamless setup.

Their expert appraisals, available in-person or via virtual video calls, provide accurate valuations for coins and bullion based on industry standards.

PPM uses GIA-certified methods for jewelry appraisals. GIA stands for Gemological Institute of America, a top expert in gems.

They also apply XRF analysis, which tests metal purity without damage. These steps often lead to valuations 20% to 30% above market rates thanks to detailed reports.

Platinum and palladium play key roles in catalytic converters. Rising industrial demand makes them a strong hedge against inflation. USGS data, Kitco, and Bullion.Directory show a 40% annual growth rate. These metals help diversify portfolios under IRS Section 408 rules for approved retirement plans. This approach reduces overall investment risks.

Protect Your Saving from Inflation and Taxes!

Company Background and Bay Area Presence

Pacific Precious Metals (PPM)'s operational model capitalizes on the unique advantages of the Bay Area, including its close proximity to the Gemological Institute of America's laboratories for efficient certifications. This positioning facilitates streamlined valuations in full compliance with California Department of Justice regulations.

Online vs. In-Person Experience at PPM

PPM gives you options with its easy online site and in-person visits. Buy coins like American Gold Eagle, Canadian Maple Leaf, Krugerrands, or British Britannia from afar.

Or visit Bay Area spots for secure deals. This fits all kinds of investors.

Non-local investors love the online platform. It lets you browse easily, order by phone, and get insured shipping.

This works great for quick buys like silver during market changes, though small fees may apply. In person at Palo Alto or Sausalito, you get fast advice and free appraisals with no shipping hassles for jewelry checks.

Mix it up with a hybrid approach. Browse and order online, then pick up in person.

Skip storage fees and check items yourself. This covers everything from quick online buys to full advice sessions.