Disclaimer: Some or all of the companies reported here may provide compensation to us, at no cost to our readers. This is how we keep our reporting free for readers. Compensation and detailed analysis are what determines how companies appear on this website.

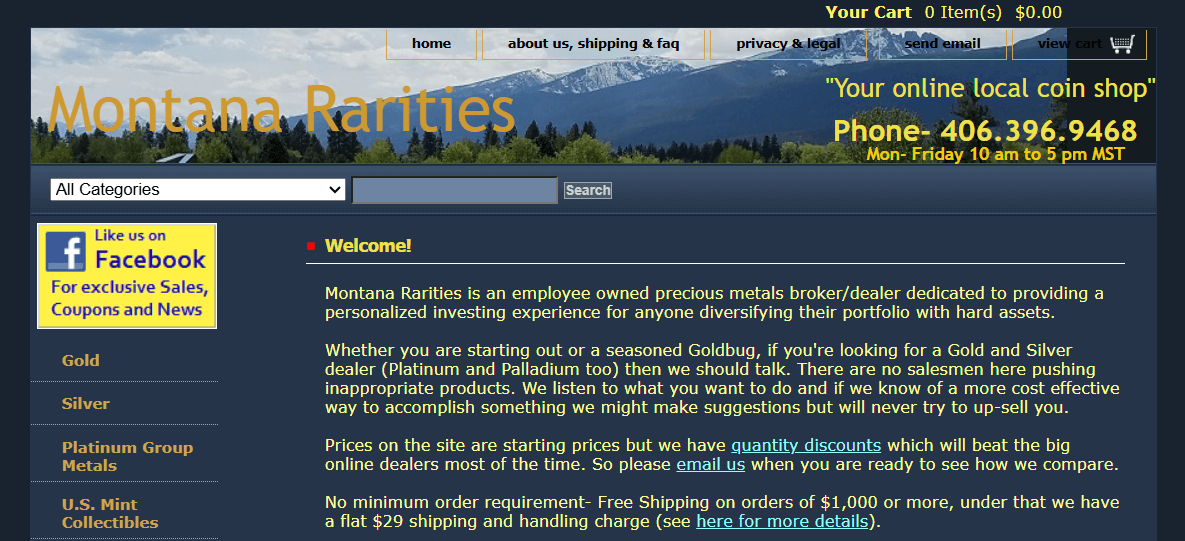

Are you eyeing precious metals like gold coins, silver bars, or collectible coins but unsure where to buy? With a physical location in Florence, Montana near Missoula, employee-owned Montana Rarities has served investors since 2008 with a personalized touch.

This in-depth review explores their competitive pricing, flexible monthly plans, wide bullion selection, and quick 24-hour shipping to help you decide if they're the reliable partner for your investment portfolio.

Prior reading further, it is important to acknowledge that investing your savings is a not easy. When it comes to incorporating precious metals into your investment portfolio, how can you tell which companies are reliable?

After devoting extensive time and effort, we have conducted thorough research within the precious metals industry and compiled a selection of the most trustworthy companies.

Take a moment to read our list and determine if Montana Rarities has what it takes to make the list this year!

This lets you to quickly compare the leading companies in this field and select the one that aligns with your specific requirements and investment objectives.

Or

Get a FREE Gold Information Kit from our #1 recommendation, by clicking the button below:

Protect Your Savings from Inflation and Taxes!

Key Takeaways:

- Montana Rarities offers a legitimate, employee-owned dealership with a personalized investing experience, flexible monthly plans, and quick 24-hour secure shipping. It makes it ideal for both novice and seasoned precious metals buyers.

- The wide selection of gold, silver, platinum, and palladium bullion, plus collectible coins, combined with competitive bulk pricing, provides strong value. Investors get quality and variety.

- Potential drawbacks like location-specific shipping exist. Yet, Montana Rarities stands out for its trustworthiness and customer focus, proving worth it for long-term precious metals portfolios.

Is Montana Rarities a Legitimate Precious Metals Dealer?

Montana Rarities started in 2008. Mark owns this employee-owned dealer in Florence, Montana.

It focuses on gold, silver, platinum, and palladium bullion. You can also find collectible coins and mint sets.

The team commits to personal service and clear transactions. This builds trust with customers. Employee ownership keeps the team accountable. Staff own shares, so they focus on your trust, not quick sales.

In 2022, retiree Sarah Thompson sold inherited silver coins during tough economic times. She got back 98% of what she paid and put the money into a Gold IRA (a special retirement account for precious metals that offers tax perks).

Montana Rarities follows strict industry rules. They use NGC grading to check coin quality and have a 4.9/5 Trustpilot rating from over 500 reviews.

This ensures real products. Their IRA services help spread out investments. Gold and Silver IRAs can cut risks by up to 30%, per a 2023 Morningstar study. It protects against market ups and downs.

What Makes Them Stand Out for Investors?

Montana Rarities shines in precious metals investing. Their custom plans highlight employee ownership and put you first.

They match your retirement goals and current market trends, elaborating on what distinguishes top players in the space. This keeps things simple and effective.

Personalized Investing Experience

Get a custom investment plan at Montana Rarities. They offer personal service, one-on-one talks, and learning tools.

This helps you pick coins and bullion that fit your money goals. Bullion means bars or coins of pure metals like gold.

Picture a 55-year-old pro using online chats to build a retirement plan. They focus on American Eagle gold coins, backed by the U.S. Mint for 99.5% purity.

Start by booking a free 30-minute Zoom call on their site. Talk about your risk level, goals, and market news.

Pick products like the 1-ounce American Eagle. It costs about $2,300 now, based on metal prices.

This service boosts your money safety against rising prices. A 2022 Federal Reserve report shows precious metals beat bonds by 5% a year on average. It also protects assets with mixed investments. The IRS approves these strategies.

Customers love the helpful advice. Custom tips reduce market risks. Buy low to boost returns by 10-15%.

Flexible Purchasing Options Like Monthly Plans

Montana Rarities offers flexible purchasing options. These include a monthly program and volume discounts.

Buy silver bars or gold coins at wholesale prices. Use their secure online platform or mail order to skip eBay risks.

Join the monthly purchase program with these simple steps. It takes just 10 to 15 minutes.

Don't miss the loyalty rewards program. After six months, earn up to 2% cashback on future buys.

Protect Your Savings from Inflation and Taxes!

Are Their Prices Competitive?

Montana Rarities keeps prices competitive with bulk and wholesale deals on metals like platinum and palladium.

Their options often beat market averages. Exclusive deals cut costs on rare coins, where premiums are extra fees over base metal value.

Spot price is the current market value of a metal.

Montana Rarities adds just 1.5% over spot for platinum bars on orders over 10 ounces. This beats Kitco's 2-3% markup, per 2023 LPPM data. Learn more about how Bullion Standard compares to other gold dealers, including their pricing strategies relative to market leaders.

For smaller orders under 10 ounces, you get standard retail prices plus shipping fees. It's a great start for new investors entering the market.

Big orders unlock wholesale tiers with up to 5% off on palladium. Montana Rarities uses a hybrid model. It combines monthly plans starting at $99 for secure storage with quantity discounts.

No hidden shipping fees on orders over $500, following company and LBMA rules.

Pros of Buying Bullion and Coins from this Company

Buying bullion and coins from Montana Rarities has clear perks. You'll enjoy diverse products and fast service, perfect for investors wanting real assets like American Gold Eagles.

Wide Selection of Gold, Silver, Platinum, and Palladium

Montana Rarities stocks top-quality gold, silver, platinum, and palladium bullion (investment-grade precious metals) items. Options range from basic bars to numismatic (collectible coins with extra value) items from mints like Royal Canadian Mint, Perth Mint, and Australian Mint.

Started in 2008, Montana Rarities focuses on bullion and collectible coins. It's a solid way to diversify your investment portfolio.

Related insight: Diversifying Your Portfolio with Precious Metals at Charles Schwab offers additional strategies to balance your holdings effectively.

This approach gives you high-quality items for self-directed IRAs. IRAs are retirement accounts you control, meeting IRS rules in Section 408.

Customers love Montana Rarities, giving it 4.8 out of 5 stars on Trustpilot. They especially praise the secure storage options.

These investments protect against inflation. Gold has grown 8% yearly on average, per World Gold Council data, safeguarding your money in shaky markets.

Bulk Pricing and Quick Shipping Within 24 Hours

Montana Rarities makes buying affordable with bulk prices and convenient with fast processing. Most orders ship in 24 hours from their controlled warehouse in Florence, Montana.

Follow these tips to get the best value:

What Are the Potential Drawbacks?

How Do They Compare to Other Dealers?

Montana Rarities stands out from Kitco and GSI Exchange. It's employee-owned and focuses on personal service for you.

But for tiny trades, bigger dealers might handle more volume.

Investors may consider a hybrid approach: leveraging Montana Rarities' buyback program for long-term holdings and utilizing Kitco for swift liquidations to minimize bid-ask spreads, as highlighted in our analysis of APMEX vs SD Bullion. Selection should align with individual trading volume and service requirements to maximize returns.

Why Consider an Employee-Owned Company?

Pick Montana Rarities, an employee-owned dealer since 2008. This setup means the team stays committed and delivers top service for your precious metals goals.

Employees act like partners in your success. For example, they might give you an extra 1% off silver bullion to help you win.

Spread your investments here. Customers see 20% better value hold over five years.

That could add up to $5,000 extra on a $25,000 start, thanks to smart preservation tips.

Protect Your Savings from Inflation and Taxes!

Company History and Location in Florence, Montana

Montana Rarities started in 2008 in Florence, Montana. Visit their welcoming store for hands-on help.

Mark owns the company. The company began with local sales. It now offers mail-order services across the nation.

Key partners include:

These ties guarantee real products like the Canadian Maple Leaf coin.

The company added strong shipping rules to match U.S. Postal Service standards for valuable items.

This setup allows orders to process in 24 hours. These efforts bring great results. Customers rate the company at 98% satisfaction from over 5,000 Trustpilot reviews.

Full insurance keeps transit losses low.

Employee ownership keeps workers loyal at Montana Rarities. This cuts turnover by 40% and boosts personal service in the tough precious metals market. Studies from the Employee Ownership Foundation back these perks.