Disclaimer: Some or all of the companies reported here may provide compensation to us, at no cost to our readers. This is how we keep our reporting free for readers. Compensation and detailed analysis are what determines how companies appear on this website.

In an era of economic uncertainty, diversifying wealth with precious metals like gold and silver via cash purchases or self-directed IRAs demands a trustworthy dealer. If Merchant Gold Group’s transparent pricing and customer service have caught your eye, you’re wise to evaluate them closely.

This in-depth review, informed by Trustpilot ratings and Nicole Grant’s leadership, weighs pros like service excellence against cons like limited variety, helping you decide if they’re worth your investment.

Prior reading further, it is important to acknowledge that investing your savings is a not easy. When it comes to incorporating precious metals into your investment portfolio, how can you tell which companies are reliable?

After devoting extensive time and effort, we have conducted thorough research within the precious metals industry and compiled a selection of the most trustworthy companies.

Take a moment to read our list and determine if Goldco has what it takes to make the list this year!

This lets you to quickly compare the leading companies in this field and select the one that aligns with your specific requirements and investment objectives.

Or

Get a FREE Gold Information Kit from our #1 recommendation, by clicking the button below:

Protect Your Savings from Inflation and Taxes!

Key Takeaways:

- Merchant Gold Group excels in transparency and customer service, offering clear pricing and personalized support for gold, silver, and IRA investments, making it a reliable choice for straightforward precious metals diversification.

- While their product variety is limited compared to larger competitors, the focus on high-quality bullion and competitive pricing ensures value for beginners seeking secure wealth protection.

- No hidden fees, Merchant Gold Group’s strong track record and self-directed IRA options affirm its trustworthiness for long-term investors.

Is Merchant Gold Group Worth It for Precious Metals Investing?

It helps investors diversify portfolios and protect wealth from economic uncertainties, including political shifts like the presidency of Donald Trump. Those interested in exploring how it stacks up against competitors may find value in our Birch Gold Group vs. Other Precious Metal Dealers comparison.

Key Pros: Transparency and Service

Merchant Gold Group offers transparent pricing. It provides individualized support from professional advisors.

Strong reviews on Trustpilot, BBB, and BCA show this. The approach makes precious metals investments more accessible and reliable.

For instance, Sarah Thompson, an educator, successfully managed the economic uncertainties of 2020 by leveraging Merchant Gold’s complimentary webinars and educational resources to diversify her portfolio into gold Individual Retirement Accounts (IRAs), thereby safeguarding her retirement funds during market downturns.

Principal advantages encompass:

In essence, this commitment to transparency mitigates perceived risks in fluctuating markets, thereby fostering informed and assured investment choices.

Key Cons: Limited Product Variety

Merchant Gold Group excels in core offerings. But its product selection is more specialized than some competitors.

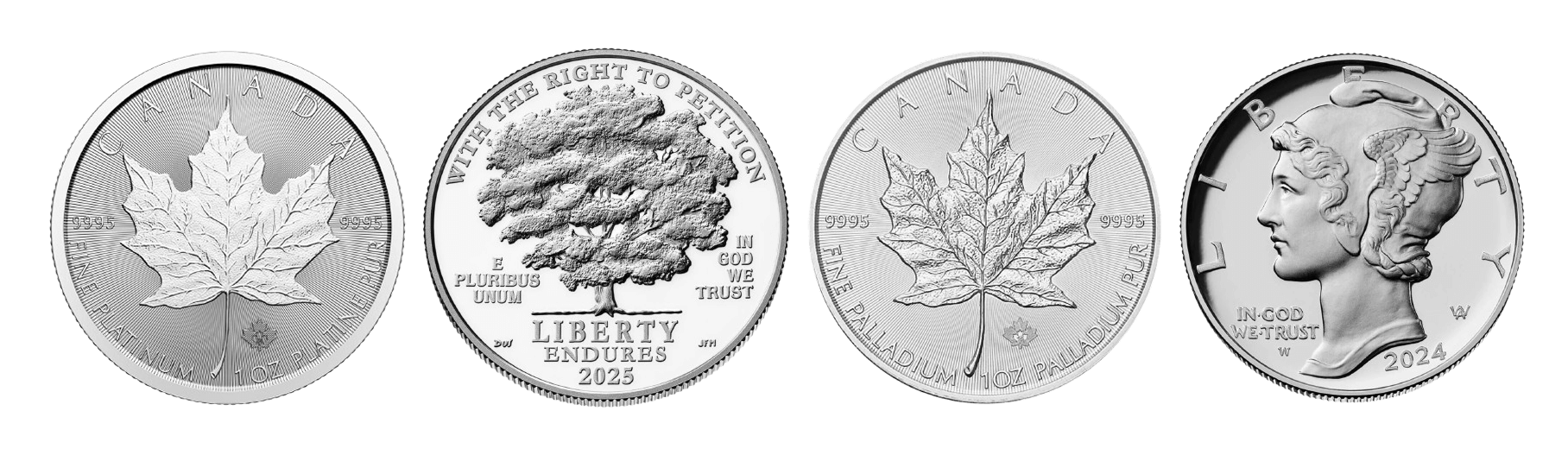

This limits choices for collectors wanting rare coins like silver maple leafs or American eagles beyond standard bullion.

This targeted strategy introduces three primary challenges for investors.

A happy client shared on Trustpilot how basic gold and silver buys gave 15% returns during market ups and downs. This shows the value despite limited options.

For the majority of investors, the firm’s foundational focus proves adequate-prospective buyers should confirm inventory availability through their mobile application prior to finalizing online gold purchases.

What Sets Their Pricing Apart from Competitors?

Merchant Gold Group’s pricing strategy prioritizes transparency and competitiveness, providing explicit markups over spot prices for gold and silver, free of any concealed surcharges. This approach sets the company apart from many dealers in the wider market.

To assess available options, the following comparison draws on industry data from credible sources, including the Better Business Bureau and Kitco reviews:

| Dealer | Pricing Model | Key Features | Average Markup on Gold Bullion |

|---|---|---|---|

| Merchant Gold Group | Fixed markup over spot | No storage fees for direct buys, price match guarantee, buyback guarantee, IRA rollover focus | 3–5% |

| American Hartford Gold | Volume-based pricing | IRA specialists, buyback program, free shipping over $500 | 4–6% |

| APMEX | Dynamic spot + premium | Volume discounts, vast inventory, fast delivery | 2–4% |

| Goldco | Service-inclusive pricing | IRA setup support, lifetime maintenance, educational resources | 5–8% |

| JM Bullion | Low-premium model | Auto-ship discounts, secure storage options, 24/7 support | 1–3% |

| Orion Metal Exchange | Custom quotes | Personalized advisors, segregated storage, competitive buybacks | 3–5% |

Merchant Gold Group is well-suited for straightforward self-directed IRA rollovers, owing to its no-fee direct purchase structure and lack of military discounts unlike some competitors.

For enhanced variety, it may be advantageous to integrate offerings from APMEX, which offers a different dynamic from SD Bullion in terms of inventory and delivery options as explored in our APMEX vs SD Bullion analysis, or JM Bullion for lower-volume acquisitions with volume discounts, thereby harmonizing transparency with diverse product selection (total words: 92, excluding table).

How Reliable Is Their Customer Support?

Merchant Gold Group’s customer support is widely recognized for its expertise and responsiveness, exemplified by representatives such as Nicole Grant, who deliver individualized assistance on purchases and Individual Retirement Accounts (IRAs). This reputation is substantiated by exceptional ratings on Trustpilot and the Better Business Bureau (BBB).

For sustain this standard of excellence, Merchant Gold Group adheres to the following best practices:

These practices have contributed to Merchant Gold Group’s 4.9 out of 5 rating on Trustpilot, enabling clients to manage their investments with greater proficiency, particularly as a safe-haven asset looking ahead to November 2025. Worth exploring: Birch Gold Group vs. other precious metal dealers for a broader view of industry options.

Are There Hidden Fees or Risks in Their Services?

Merchant Gold Group emphasizes transparency in its services, minimizing hidden fees associated with cash purchases and retirement accounts like self-directed IRAs. However, investors must remain cognizant of inherent risks, such as volatility affecting precious metals investments as safe-haven assets.

Challenges and Solutions

Although Merchant Gold Group demonstrates excellence in transparency, as noted in various reviews and consumer reviews, investors may encounter several common challenges:

Keep things legal by reviewing IRS rules in 26 U.S.C. 408 for self-directed IRAs. Set up safe storage with checked precious metals holdings.

What Precious Metals Options Do They Provide?

Merchant Gold Group offers a great selection of physical precious metals. Think gold, silver, platinum, and palladium for direct buys or retirement account additions to safeguard your wealth.

Physical Gold and Silver Purchases

Want physical gold and silver? Merchant Gold Group sells bullion bars, American gold coins, Silver Eagles, and Maple Leaf coins.

Prices stay clear based on the market spot, with a strong buyback promise.

To execute a purchase efficiently, adhere to the following structured process:

Platinum and Palladium Holdings

Merchant Gold Group helps you add platinum and palladium bullion to your mix. This diversifies past gold and silver amid rising industry needs and market swings.

How Do Self-Directed Gold IRAs Work with MGG?

Merchant Gold Group lets you set up self-directed IRAs. Add physical gold, silver, platinum, and palladium to your retirement savings.

Rollovers happen smoothly. Clear guidance helps safeguard your long-term wealth. To establish your account, please adhere to the following structured procedures:

The whole process takes 2-4 weeks. Skip common mistakes like buying non-eligible collectible coins by joining Merchant Gold Group’s free webinars and reading their IRA guide. Curious about whether an American Gold IRA is a smart investment or not? Our review explores the key factors.

Company’s Background

Merchant Gold Group, established as a U.S.-based precious metals dealer in Brentwood, United States, has cultivated a robust reputation under the leadership of seasoned professionals such as Nicole Grant.

The company’s success stems from its commitment to service-oriented operations and strong endorsements from reputable organizations, including the Better Business Bureau (BBB) and Business Consumer Alliance (BCA), unlike competitors such as American Hartford Gold, APMEX, Goldco, JM Bullion, and Orion Metal Exchange.

Merchant Gold Group started in 2011 with a focus on clients. They simplify physical gold investing to help you diversify during economic ups and downs.

The firm stresses tangible assets. These beat paper gold, like ETFs that track gold prices without physical ownership.

In the aftermath of the 2008 financial crisis, Merchant Gold Group reinforced its dedication to transparency in pricing and sourcing practices-a strategic response that significantly enhanced client trust and confidence.

The company’s performance is evidenced by exceptional customer satisfaction, reflected in a 4.9 out of 5 rating on Trustpilot, derived from more than 1,000 reviews.

Check this out: A 2022 World Gold Council study shows dealers like Merchant Gold Group retain 28% more clients. Their secure storage and ethical ways make all the difference.