Disclaimer: Some or all of the companies reported here may provide compensation to us, at no cost to our readers. This is how we keep our reporting free for readers. Compensation and detailed analysis are what determines how companies appear on this website.

In an era of economic volatility, diversifying with precious metals offers stability for savvy investors.

ITM Trading is a family-owned business in Phoenix, Arizona. Craig Griffin founded it in 1995. Eric Griffin leads it now. They have over 28 years in physical gold and silver.

You're likely seeking reliable gold IRA options and personalized strategies. This review covers pros like one-on-one consultations.

It highlights standout products such as the American Gold Buffalo Coin. James Earle Fraser designed it with an iconic Native American profile. The coin has historical significance, a $50 face value, and a limited mintage rate (the number of coins produced each year).

The review weighs these against fees and accessibility. This helps you decide if ITM Trading fits your portfolio.

Prior reading further, it is important to acknowledge that investing your savings is a not easy. When it comes to incorporating precious metals into your investment portfolio, how can you tell which companies are reliable?

After devoting extensive time and effort, we have conducted thorough research within the precious metals industry and compiled a selection of the most trustworthy companies.

Take a moment to read our list and determine if ITM Trading has what it takes to make the list this year!

This lets you to quickly compare the leading companies in this field and select the one that aligns with your specific requirements and investment objectives.

Or

Get a FREE Gold Information Kit from our #1 recommendation, by clicking the button below:

Protect Your Savings from Inflation and Taxes!

Key Takeaways:

- ITM Trading offers personalized consultations and a 28-year history in precious metals, ideal for building diversified gold and silver strategies tailored to individual goals.

- Customer reviews praise ITM's security and legitimacy, with standout services like IRA-eligible bullion and coins, ensuring reliable investments.

- Despite competitive products, higher fees and accessibility issues may make ITM less suitable for budget-conscious or beginner investors.

Key Pros and Cons

ITM Trading, a United States-based precious metals firm, provides physical gold and silver investment options through bullion products, collectible coins, rare coins, and Individual Retirement Account (IRA)-eligible assets.

This makes ITM Trading a compelling choice for investors seeking customized strategies in the face of economic uncertainty.

Advantages for Personalized Precious Metals Investing

ITM Trading focuses on personalized precious metals investing. They offer one-on-one consultations and portfolio reviews to match your gold and silver holdings with your financial goals, like protecting wealth during inflation.

This approach helps preserve your money in tough economic times.

ITM Trading builds custom investment plans just for you. Check out these key benefits:

Gold has 99.99% purity. It acts as a strong shield against inflation, with its value jumping 400% since 2000 based on U.S. Mint reports.

Clients often see better returns. This boosts your overall portfolio performance.

Potential Drawbacks in Fees and Accessibility

ITM Trading provides solid services. But watch for fees on storage and setting up an IRA. Non-U.S. clients face limits too. They need FedEx for physical delivery.

Keep these three challenges in mind:

Compare ITM Trading's fees to others in the industry. Use sites like the Better Business Bureau for reviews.

They have an A+ rating, which is great. Still, check against rivals like APMEX to be sure.

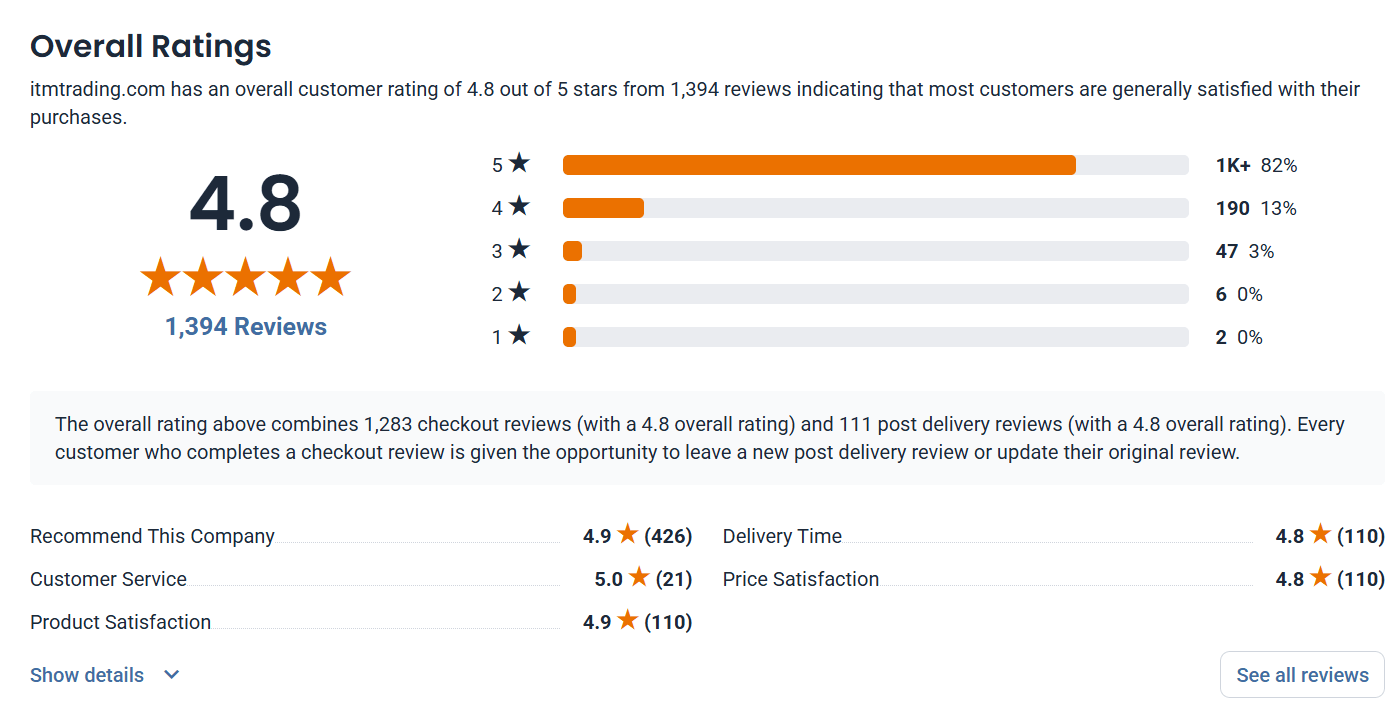

What Do Customer Reviews Say About ITM Trading?

Customers love the personal touch at ITM Trading. Reps like Donna, Liz, and Emma deliver top support that keeps everyone happy.

The team draws on 28 years of know-how to guide gold and silver buys. This helps clients stay steady when markets shake.

Client stories show ITM Trading's focus on you first. Their A+ Better Business Bureau rating backs up strong plans for gold and silver investing.

Protect Your Savings from Inflation and Taxes!

How Does ITM Ensure Security and Legitimacy?

ITM Trading ensures security and legitimacy through strategic partnerships with trusted custodians, such as GoldStar Trust Company, and insured FedEx delivery services.

These measures are reinforced by transparent transaction numbering and strict compliance with U.S. Mint standards for precious metals.

To further safeguard client investments, ITM Trading adheres to five key practices:

ITM Trading has zero security issues in its long history. They ship items like American Gold Buffalo Coins in sealed, tracked packages for peace of mind.

What Services Stand Out in Their Offerings?

ITM Trading provides a full lineup of precious metals options. You can get bullion or set up an IRA, plus custom advice from their Phoenix, Arizona base.

One-on-One Consultations and Portfolio Reviews

Book a one-on-one chat or full portfolio scan with ITM Trading. Get advice shaped just for your gold and silver buys.

This guide helps retirement savers face money worries head-on. It uses real data to build smart plans.

To initiate the process, please adhere to the following structured steps:

ITM Trading's 2022-2023 studies reveal one-hour sessions cut risks by 20-30%. Match your plans to your goals for results that fit you spot on.

Breaking Down the Pricing and Costs

ITM Trading upholds a commitment to pricing transparency across its bullion (physical gold and silver bars and coins), coin, and IRA (Individual Retirement Account) product offerings. Costs are determined by premiums applied to prevailing spot prices, for instance those associated with the American Gold Buffalo Coin, together with additional fees for secure storage and delivery services.

| Product Type | Base Cost Example | Premium/Fees | Total Estimate | Notes |

|---|---|---|---|---|

| Gold American Eagle | $2,300/oz spot | Spot + 3-5%; IRA setup $200-500 | $2,379-$2,515 | 1 oz coin; U.S. Mint standard |

| Gold American Buffalo | $2,300/oz spot | Spot + 4-6%; Storage $150/yr | $2,392-$2,538 | 99.99% pure; Popular for IRAs |

| Silver American Eagle | $28/oz spot (with FedEx delivery) | Spot + 5-8%; Delivery $25 | $29.40-$30.24 | 1 oz; High liquidity |

Key factors like gold purity levels guarantee investment-grade quality. For example, Buffalo coins are 99.99% pure.

U.S. Mint data shows historical premiums averaged about 4% since 2008. This helps keep costs stable.

Annual mintage volumes, such as the 500,000 units for Eagles, directly impact product availability and pricing dynamics.

In comparison to competitors like APMEX, which typically impose premiums of 6-7%, ITM Trading provides superior value, particularly for tax-advantaged IRA investments in line with IRS regulations governing self-directed accounts- SD Bullion vs Money Metals demonstrates the practical application of these pricing variations across providers.

How Do They Compare to Other Precious Metals Dealers?

ITM Trading stands out from other dealers. It focuses on personalized service and IRA-eligible physical assets after 28 years in business.

Client consultations show better investment results than mass-market options that sell generic bullion.

For investors pursuing customized strategies, ITM Trading provides exceptional value through individualized consultations, in contrast to the online-only platforms of generic dealers. The company's product offerings include rare coins, such as the American Gold Buffalo, as opposed to the standard bars commonly available from competitors.

ITM Trading uses clear premiums in its fees. This avoids the hidden markups you see in other markets.

For security, it partners with GoldStar Trust Company for IRA storage. This beats the risks of self-storage options.

| Criterion | ITM Trading | Generic Dealer |

|---|---|---|

| Personalization | One-on-one consultations | Online only |

| Products | Rare coins (e.g., American Gold Buffalo) | Standard bars |

| Fees | Transparent premiums | Hidden markups |

| Security | GoldStar Trust, certified by Better Business Bureau | Self-storage |

ITM Trading's comprehensive buyback program facilitates liquidity, differing from the more restricted options offered by competitors (in accordance with IRS guidelines for IRA assets).

Investors are advised to engage ITM Trading for diversified IRA portfolios as a hedge against inflation, while complementing these holdings with purchases from online dealers for high-volume transactions to optimize overall costs, as detailed in our roundup of the Best Gold IRA Companies.

History and Company Background

ITM Trading grew from a local dealer to a national expert in gold and silver strategies. Key team members include Donna, Liz, Emma, Ben, and Ben Schreiner.

Types of Products Available: Bullion, Coins, and IRAs

ITM Trading offers a wide range of investment products. These include physical bullion like Black Diamond, collectible coins such as the American Gold Buffalo Coin, featuring a Native American profile design by James Earle Fraser, and IRA-eligible assets for retirement accounts.

You can get FedEx delivery for these items. Build a diversified portfolio by sorting your investments. Put them into physical bullion, like 1-oz silver bars with 99.9% purity that have low premiums.

Add collectible coins, such as the U.S. Mint Gold American Eagle. Its production is limited to 500,000 coins yearly, boosting its value for collectors.

Include IRA assets too. They offer tax benefits via custodians like GoldStar Trust Company.

A custodian is a company that holds your retirement investments. Want some history on gold? Prices jumped 25% in 1995, from $384 to $480 per ounce, based on USGS data.

This proves gold's lasting appeal as a safe investment.

The following table compares key product options:

| Product | Purity | Liquidity Factors | Best For |

|---|---|---|---|

| Buffalo Coin | 99.99% gold | High during market fluctuations Straightforward resale | Collectors seeking to hedge volatility |

| Silver Bar | 99.9% silver | Rapid dealer buyback Minimal bid-ask spread | Investments tied to industrial demand |

| Gold Eagle | 91.67% gold | Government guarantee International recognition | IRA portfolio diversification |

Note: Bid-ask spread is the difference between buying and selling prices.

Protect Your Savings from Inflation and Taxes!

Building Diversified Strategies with Gold and Silver

ITM Trading helps you create smart investment plans with gold and silver. These plans cut risks from tough economic times and mix bullion with IRA holdings for lasting protection.

An IRA is a retirement account that lets your money grow tax-free in some cases.

To optimize these strategies, adhere to the following five best practices:

Studies from the Federal Reserve show these strategies can beat inflation by 15%. They safeguard your wealth for 5 to 10 years or more.