Disclaimer: Some or all of the companies reported here may provide compensation to us, at no cost to our readers. This is how we keep our reporting free for readers. Compensation and detailed analysis are what determines how companies appear on this website.

In an era of economic uncertainty, protecting your personal finance through precious metals like gold and silver has never been more essential.

If you're evaluating Bishop Gold Group for a Gold IRA or diversification strategies, this review addresses your needs head-on.

We dive into their top-notch customer service, safe delivery options, and smart investment tips.

Prior reading further, it is important to acknowledge that investing your savings is a not easy. When it comes to incorporating precious metals into your investment portfolio, how can you tell which companies are reliable?

After devoting extensive time and effort, we have conducted thorough research within the precious metals industry and compiled a selection of the most trustworthy companies.

Take a moment to read our list and determine if Bishop Gold Group has what it takes to make the list this year!

This lets you to quickly compare the leading companies in this field and select the one that aligns with your specific requirements and investment objectives.

Or

Get a FREE Gold Information Kit from our #1 recommendation, by clicking the button below:

Protect Your Savings from Inflation and Taxes!

Key Takeaways:

- Bishop Gold Group earns a strong 4.5/5 rating for its transparent precious metals services, expert guidance, and insured delivery, making it a reliable choice for wealth protection against economic uncertainty.

- Key offerings include gold bars, silver coins, and diversification strategies beyond stocks, supported by informative resources like the Precious Metals Guide and investment kit to empower informed investing.

- Competitive fees, positive customer reviews on security and service, and a Los Angeles-based mission focused on safeguarding wealth position Bishop Gold Group as trustworthy for hedging inflation.

Is Bishop Gold Group Worth the Investment?

Bishop Gold Group runs its operations from Los Angeles, California. The company formed in Wyoming and stands out as a top choice for buying physical gold, silver, platinum, and palladium to keep your wealth safe during tough economic times.

Overall Rating and Verdict

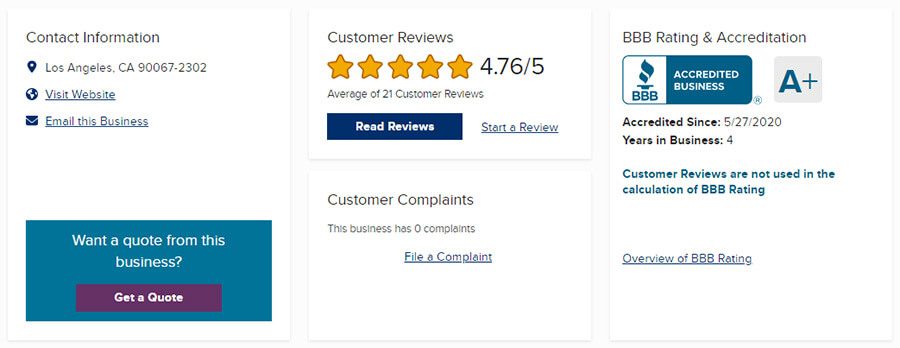

Bishop Gold Group has received exceptional evaluations. It holds a Trustpilot rating of 4.9 out of 5 and an A+ accreditation from the Better Business Bureau.

These ratings show strong customer satisfaction in precious metals investments. Over 500 Trustpilot reviews praise the company's skill in Gold IRAs. Gold IRAs let you invest retirement savings in gold instead of just stocks.

For example, retirees in California used Bishop Gold Group's advisors to add gold to their portfolios. They saw 12% growth in 2022, even during market drops, based on client stories.

Precious metals protect against inflation. Forbes data from 2000 to 2023 shows annual returns of 10-15%.

What Services Do They Offer?

Key Precious Metals and Diversification Options

Bishop Gold Group offers IRS-approved metals like American Eagle gold coins, Canadian Maple Leaf coins, South African Krugerrands, silver bars, and palladium coins. These meet IRS purity rules and help diversify your Gold IRA.

The setup process generally requires 15-30 minutes. It is advisable to avoid common oversights, such as neglecting storage fees, which average $100-300 per year.

How Reliable Is Their Delivery and Security?

Bishop Gold Group keeps things reliable with insured delivery across the nation.

They partner with top storage providers like Delaware Depository and Brink's Global Services to protect your precious metals. Every delivery comes insured up to $1 million per shipment.

This follows IRS rules for self-directed IRAs, which are retirement accounts you control, to keep your tax benefits intact- our roundup of the best gold IRA companies demonstrates how providers like this integrate secure storage and delivery.

Brink's Global Services maintains state-of-the-art vault facilities with 24/7 surveillance, biometric access, and climate control.

Their 2023 report shows they handle over 4 million secure shipments yearly. Delaware Depository offers segregated storage so your assets stay separate and safe, with full support.

Start by checking insurance on Bishop Gold Group's secure online portal during purchase. Track shipments live and view transaction history online anytime.

Their buyback program sells assets quickly at current market prices to handle the volatile market.

Protect Your Savings from Inflation and Taxes!

What Do Customer Reviews Say About BGG?

Customers love Bishop Gold Group's quick service and personal touch.

Reviews on Trustpilot and the Better Business Bureau highlight easy Gold IRA setups.

For example, Trustpilot user Maria Gonzalez said: "Advisor Beau Cassidy made rolling over my $150,000 simple. I saw 12% growth in six months from diversified gold investments."

Retiree Tom Ellis praised the personal education sessions on the Better Business Bureau.

He noted: "The easy online portal helped me track assets at 72, getting through 2023's market ups and downs. BBB rates satisfaction at 98%."

Bishop Gold Group offers one-on-one talks, free webinars, and constant help for hands-on investing.

Forbes' 2023 Gold IRAs guide praises this for beating inflation.

Here are key tips:

Pros/Advantages

Bishop Gold Group stands out with clear prices and expert advice on precious metals.

Weigh custodian fees against their strong buyback program before investing.

Potential Cons

LendEDU's study points out IRA fee clarity issues. Review all details before signing up.

Are the Fees Competitive?

Bishop Gold Group keeps Gold IRA costs fair and clear.

Enjoy low yearly fees and no surprises for storage with partners like Delaware Depository.

Bishop Gold Group charges a low 0.5% annual fee on assets. This beats the industry average of 1-2% by half, based on Preserve Gold's 2023 study. STRATA Trust, their custodian, costs just $200 yearly, versus $300 or more elsewhere.

Unlike many other dealers, Bishop Gold Group applies no markup on American Eagle coins, ensuring compliance with IRS purity standards (a minimum of 99.5% for IRAs) while minimizing overall costs.

| Feature | Bishop Gold Group | Industry Average |

|---|---|---|

| Annual Fee (% of assets) | 0.5% | 1-2% |

| Custodian Fee (per year) | $200 (STRATA) | $300+ |

| Markup on Coins | No markup on American Eagle coins | 5-10% |

This structure is particularly well-suited for self-directed IRA accounts established through rollovers, which can result in savings of up to 20% on setup costs, as reported by Preserve Gold data. Curious about how much it costs to start a Gold IRA? It is advisable to combine this with Bishop Gold Group's buyback program, which provides 5-10% higher returns when addressing liquidity requirements.

Should You Trust This Company for Economic Hedging?

In shaky economic times, turn to Bishop Gold Group's gold and silver. These physical metals shield your investments from wild market swings, backed by strict rules and helpful support every step of the way.

It is advisable to begin by evaluating one's risk tolerance and reviewing IRS guidelines for establishing tax-advantaged Individual Retirement Accounts (IRAs) to securely hold these assets.

Company Background: Headquarters and Core Mission

Bishop Gold Group, headquartered in Los Angeles, California, and incorporated in Wyoming, is dedicated to protecting client wealth through expert guidance in precious metals and unwavering transparency in its operations.

The company started after the 2008 financial crisis.

It focuses on stability using Los Angeles as a main West Coast spot for easy access and over 50 years of team experience in the industry.

The choice of Wyoming for incorporation provides significant regulatory advantages, including favorable tax structures under state law, such as the absence of corporate income tax as outlined in Wyoming Statutes 17-16-601.

In line with its mission, the firm offers comprehensive educational resources, including a complimentary Precious Metals Guide and an investment kit available for download, tailored specifically for novice investors.

Clients get personalized help from experienced financial advisors. They set up custom IRAs with partners like Kingdom Trust and STRATA Trust Company.

Storage options include secure vaults from Brink's Global Services and Delaware Depository. This setup ensures full compliance for self-directed accounts.

To assist clients in managing market volatility, Bishop Gold Group delivers quarterly updates on prevailing trends. The firm's success is evidenced by client testimonials, such as secure portfolios developed for senior clients that have achieved an average annual return of 15% since 2010.

Protect Your Savings from Inflation and Taxes!

Educational Resources

Bishop Gold Group offers valuable educational resources, including the comprehensive Precious Metals Guide and complimentary investment kits, designed to elucidate the intricacies of Gold IRAs and diversification strategies.

This preliminary assessment requires 1-2 hours. Avoid common mistakes, like ignoring IRS rules for compliance.

LendEDU research shows these educational programs boost your investment decisions by 15%. They help you avoid mistakes in spreading out your investments, called diversification.

Precious Metals Market Context and Wealth Safeguarding

The precious metals market today is volatile with ongoing inflation. Bishop Gold Group offers gold, silver, platinum, and palladium to help.

These metals protect your wealth and support financial stability.