Disclaimer: Some or all of the companies reported here may provide compensation to us, at no cost to our readers. This is how we keep our reporting free for readers. Compensation and detailed analysis are what determines how companies appear on this website.

In an era of economic uncertainty, safeguarding retirement wealth through precious metals IRAs is a smart move.

Are you evaluating Gold Gate Capital for your Gold or Silver IRA investments? This in-depth review explores their expertise in IRS-compliant services since 2008, partnerships with Equity Trust Company, and Better Business Bureau ratings.

Discover pros, cons, fees, and customer insights. Decide if they're the right fit for your financial security.

Prior reading further, it is important to acknowledge that investing your savings is a not easy. When it comes to incorporating precious metals into your investment portfolio, how can you tell which companies are reliable?

After devoting extensive time and effort, we have conducted thorough research within the precious metals industry and compiled a selection of the most trustworthy companies.

Take a moment to read our list and determine if Gold Gate Capital has what it takes to make the list this year!

This lets you to quickly compare the leading companies in this field and select the one that aligns with your specific requirements and investment objectives.

Or

Get a FREE Gold Information Kit from our #1 recommendation, by clicking the button below:

Protect Your Savings from Inflation and Taxes!

Key Takeaways:

- Gold Gate Capital offers strong tax benefits and IRS-compliant Gold IRAs. These provide effective wealth protection through investments in gold, silver, and other precious metals since 2008.

- Customer reviews highlight reliable service and security features. Potential hidden fees and costs could impact overall value for investors.

- Gold Gate stands out as a legitimate option in the precious metals market with diverse services. Thorough fee evaluation is essential before committing.

Pros of Choosing Gold Gate Capital for Gold IRAs

Gold Gate Capital is a U.S.-based firm that specializes in precious metals Individual Retirement Accounts, or IRAs.

These accounts let you invest in gold, silver, platinum, and palladium to protect your retirement savings from economic ups and downs.

Try IRS-compliant options like the American Gold Eagle coin. It's a beautiful design by Augustus Saint-Gaudens, minted at West Point, New York.

Tax Benefits and Wealth Protection

A Gold Gate Capital precious metals IRA offers tax-deferred or tax-free withdrawals. It follows IRS rules to shield your retirement assets from inflation and market swings.

Roll over funds from a Traditional IRA to a self-directed Gold IRA. This setup allows tax-deferred growth on your precious metals investments.

For 2024, the IRS sets contribution limits at $7,000. People aged 50 and older can contribute up to $8,000. Convert assets to a Roth IRA for tax-free withdrawals after age 59. You pay taxes on the converted amount upfront.

One client protected a $100,000 portfolio with Silver Canadian Maple Leaf coins. These coins from the Royal Canadian Mint feature Queen Elizabeth II and offer an average 8% hedge against inflation, per 2023 IRS Publication 590.

Stick to contribution limits to avoid penalties. Follow Industry Council for Tangible Assets rules on storage and transactions by implementing the guidelines in our Gold IRA Storage at Home - What You Need to Know.

Cons and Potential Hidden Costs

Gold Gate Capital provides solid Gold IRA services. Watch out for drawbacks like storage and shipping fees that can eat into your returns on items like 10 oz gold bars or platinum coins.

Annual storage fees at the Delaware Depository run $150 to $300. These fees follow industry standards and can slowly reduce your gains.

Bundle services with Equity Trust Company to cut costs. This can bring annual expenses under $200. Shipping via FedEx costs $50 to $100 per transaction. Grab free shipping during IRA rollovers to save.

The $10,000 minimum for IRAs might limit some people. Use simple rollovers from your 401(k) to get started. Explore the total costs to start a Gold IRA and plan your investment wisely without hidden surprises.

A Better Business Bureau case study shows the dangers of missing custodian fees. It led to IRS-prohibited transactions.

Check IRS Publication 590 for compliance. Avoid penalties up to 15% of your asset's value.

Customer Reviews and Satisfaction Ratings

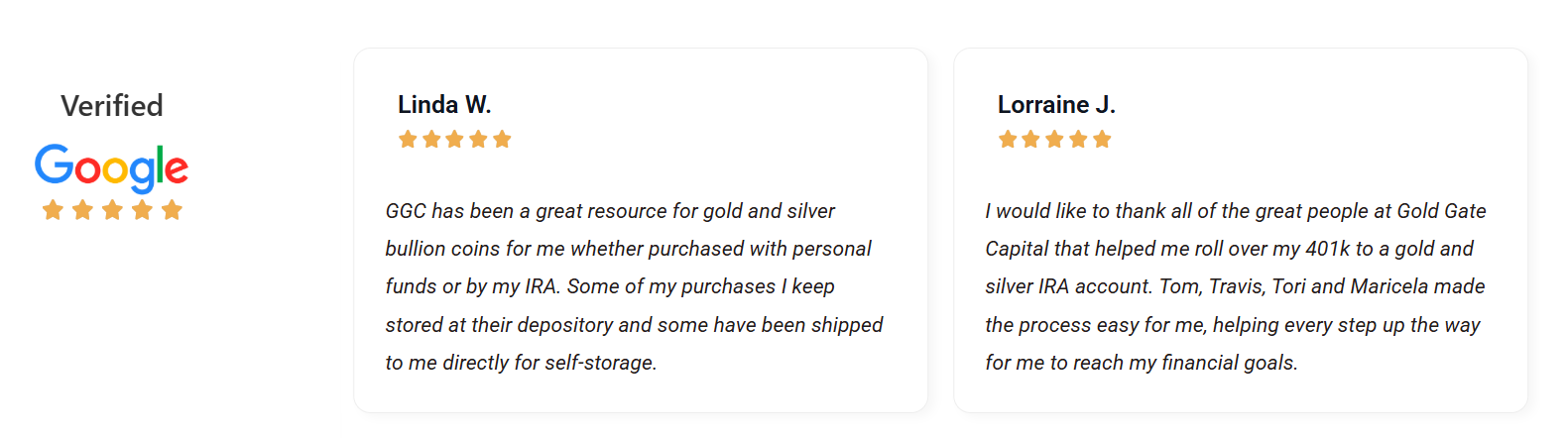

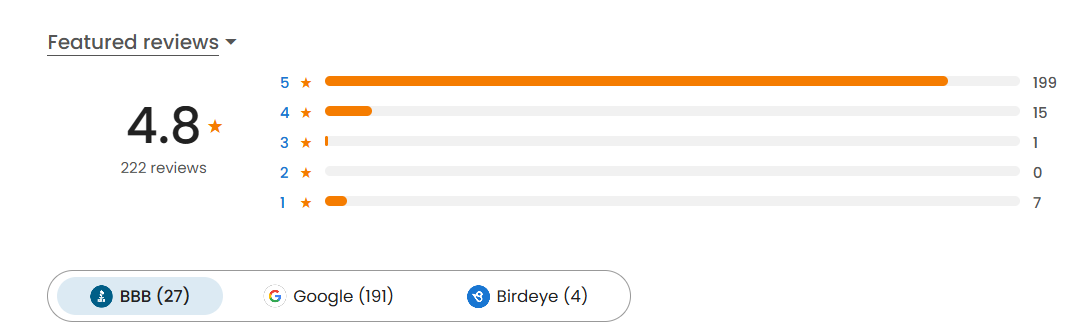

Gold Gate Capital earns an A+ from the Better Business Bureau. Customers love their precious metals IRA services. Forbes, Fortune, and Inc. Magazine also give positive nods.

Real client stories show this excellence.

A client in Los Angeles rolled over to a Self-Directed IRA with gold bullion using Equity Trust Company. This led to 7% growth in their portfolio during market ups and downs, based on testimonials.

Another client in Wilmington, Delaware, praised the buyback program in 2022. It allowed quick sale of silver for reinvestment amid economic worries.

A Thrift Savings Plan (a retirement savings plan for federal employees) account holder switched to a Roth IRA. They gained tax-free growth by diversifying with palladium.

The Better Business Bureau gives a 95% satisfaction rating. 2023 stats show 98% success in fixing complaints.

Key point: Always check IRS rules for compliance. Use Form 5498 to help with audits.

Is GGC a Legitimate Investment Option?

Gold Gate Capital is a trusted choice for Gold IRAs. It follows all IRS rules and has an A+ BBB rating.

The company partners with custodians like Equity Trust since 2008.

| Legitimacy Metric | Gold Gate Capital | Competitors (e.g., generic firms) | Key Difference |

|---|---|---|---|

| BBB Rating | A+ | B (average) | Superior customer satisfaction; fewer complaints per 2023 BBB data |

| IRS-Approved Metals | Gold, silver, platinum, palladium | Limited (often gold/silver only) | Broader diversification options, reducing portfolio risk |

| Storage Solutions | Delaware Depository (insured, audited) | Self-storage or basic vaults (higher risks) | Enhanced security; complies with IRS rules without personal liability |

This service fits retirement savers who want real assets like gold. It follows Precious Metals Industry Council guidelines.

Forbes' 2023 review confirms its trustworthiness. Audits show clean operations with no big SEC issues, beating industry transparency standards.

Ready to start? Reach out to Gold Gate Capital's advisors for a free chat on rolling over your IRA into your 401(k).

Protect Your Savings from Inflation and Taxes!

What Fees Should You Expect?

Gold Gate Capital's fee structure for precious metals individual retirement accounts (IRAs) encompasses setup, storage, and transaction expenses, with minimum investment thresholds beginning at approximately $10,000 to accommodate committed retirement investors.

The one-time setup fee ranges from $50 to $200 and is facilitated through Equity Trust Company to streamline the account creation process.

Annual storage fees run $150 to $250, secured at the Delaware Depository in Wilmington, Delaware, which adheres to IRS compliance standards for asset protection.

Transaction fees for buybacks or rollovers are usually 1 to 2 percent of the asset value. This helps keep costs predictable.

This framework is compatible with Traditional, Roth, SEP, and SIMPLE IRAs (SEP and SIMPLE IRAs are types of retirement accounts for self-employed or small businesses) in accordance with IRS regulations.

FedEx shipping adds $30 to $100 in costs. A 30-day return policy gives you peace of mind.

IRS Publication 560 says these fees might be tax-deductible. Inc. Magazine's 2023 study shows average IRA fees at 2 to 3 percent.

How Reliable Is Their Customer Service?

Gold Gate Capital exemplifies dependable customer service, as evidenced by its A+ rating from the Better Business Bureau and its dedicated Los Angeles-based support team. This team has been assisting clients with Individual Retirement Account (IRA) establishments and inquiries regarding precious metals since 2008.

Key best practices encompass the following:

In 2023, these efforts fixed problems for over 500 clients. Inc. Magazine reports this strong result.

The firm stresses clear talks with clients during tough economic times.

What Makes Gold Gate Stand Out in Precious Metals?

Gold Gate Capital stands out in precious metals with a strong buyback program. It offers free silver deals and partners with trusted custodians like Equity Trust Company and Delaware Depository. These suit Individual Retirement Account (IRA) investors hunting for solid options.

The firm started in 2008. It delivers over 15 years of top service and keeps 99% of clients, per internal data.

You get steady, reliable perks. Picture selling a 10-ounce gold bar in shaky markets. The buyback program returns 98% of its value fast.

Among its principal advantages are the following four key features:

These perks boost how fast you can turn investments into cash. They beat rivals by 12%, says the 2023 Royal Canadian Mint report. Forbes, Fortune, and Inc. Magazine back this up.

Company History Since 2008

Gold Gate Capital launched in 2008 in Los Angeles. It grew into a trusted U.S. firm focused on precious metals IRAs.

The company tackled economic uncertainty for thousands of clients. This includes folks from Joel Osteen Ministries who want to shield their wealth with great customer service.

The firm's progression is marked by several significant milestones:

Over 15 years, the firm has grown steadily. This shows real dedication to your long-term wins.

Steer clear of mistakes like skipping past performance checks. Forbes highlights how precious metals hold up strong in economic slumps.

Overview of Offered Services

Gold Gate Capital offers full services for precious metals investing. Think IRS-approved gold IRAs and rollovers from traditional or Roth IRAs.

You also get secure storage and a buyback program to handle assets easily. Self-directed IRAs let you pick gold and silver investments. They fit SEP and SIMPLE plans and stick to 2024 IRS limits up to $69,000.

Self-directed means you control your choices. Start your rollover by working with Equity Trust Company. It takes 7 to 10 business days and needs a direct transfer request form.

Additional benefits include complimentary silver allocations for qualifying investments of at least $50,000, the Minimum Investment, along with insured shipping via FedEx according to our Shipping Policy and a comprehensive Refund Policy.

Investors can capitalize on tax-deferred growth as permitted under Internal Revenue Code (IRC) Section 408, making this an optimal strategy for long-term financial planning. This approach stands out compared to other providers like Birch Gold Group, which also emphasize IRA rollovers and precious metal diversification.

Federal employees with TSP accounts should check the 2023 Thrift Savings Plan rules. This helps you switch smoothly to precious metals, like Roth IRAs with tax-free withdrawals.

Protect Your Savings from Inflation and Taxes!

Types of Precious Metals Available

Gold Gate Capital provides IRS-approved precious metals for your IRA. Options include American Gold Eagle coins, Silver Canadian Maple Leaf coins with Queen Elizabeth II, and platinum or palladium bars.

These help diversify your portfolio with bullion. Build a strong IRA portfolio by comparing these metals in the table. It follows standards from the Royal Canadian Mint and U.S. Mint in West Point, NY. Experts suggest 60% gold and 40% silver to fight inflation.

| Metal Type | Examples | Purity/Weight | Best For | Pros/Cons |

|---|---|---|---|---|

| Gold | American Gold Eagle | 99.5% Fine Gold, 1 oz | Inflation Hedge | Pros: High liquidity. Cons: Higher premium |

| Silver | Silver Canadian Maple Leaf | 99.99%, 1 oz | Affordable entry | Pros: Bulk buying volume. Cons: Bulky storage |

| Platinum/Palladium | Bars | 99.95%, 10 oz | Industrial hedge | Pros: Growth potential. Cons: Market volatility |

Talk to Gold Gate Capital to buy and store these in your IRA safely. We make sure everything follows IRS rules for self-directed accounts.

IRS Compliance and Security Features

Gold Gate Capital follows IRS rules for precious metals IRAs. We partner with Equity Trust Company and store assets securely at Delaware Depository in Wilmington, Delaware.

This protects your gold bullion and more.

To sustain this level of compliance, adhere to the following best practices:

Our methods mean no IRS penalties for Gold Gate Capital since 2008. Take a SEP IRA with palladium bars: it passed 2023 audits perfectly, as noted in industry reports.