Disclaimer: Some or all of the companies reported here may provide compensation to us, at no cost to our readers. This is how we keep our reporting free for readers. Compensation and detailed analysis are what determines how companies appear on this website.

Are you eyeing investment-grade precious metals like Gold Eagles or Silver Rounds from a trusted dealer? Gainesville Coins, based in Tampa, Florida, offers seamless ordering, secure payment options, and reliable shipping to U.S. and global clients.

This in-depth review evaluates their legitimacy, competitive pricing, IRA services, and vault storage. This helps you decide if they are worth adding to your portfolio.

The company has handled billions in transactions.

Prior reading further, it is important to acknowledge that investing your savings is a not easy. When it comes to incorporating precious metals into your investment portfolio, how can you tell which companies are reliable?

After devoting extensive time and effort, we have conducted thorough research within the precious metals industry and compiled a selection of the most trustworthy companies.

Take a moment to read our list and determine if Gainesville Coins has what it takes to make the list this year!

This lets you to quickly compare the leading companies in this field and select the one that aligns with your specific requirements and investment objectives.

Or

Get a FREE Gold Information Kit from our #1 recommendation, by clicking the button below:

Protect Your Saving from Inflation and Taxes!

Key Takeaways:

- Gainesville Coins stands out as a legitimate dealer with veteran staff handling billions in transactions, offering secure storage and IRA services for precious metals investors.

- Customer reviews highlight competitive pricing and reliable global shipping to over 70 countries, though some note higher premiums on certain items.

- Overall, it's worth it for serious investors seeking expertise and specialized offerings, but compare prices with competitors to ensure best value.

Is Gainesville Coins Worth the Investment?

Gainesville Coins is a Tampa-based dealer. They specialize in investment-grade precious metals like gold, silver, platinum, and palladium.

Examples include Gold Eagles, coins, and bars.

This company offers great value for investors. They focus on secure and reliable precious metals options. Worth exploring: CMI Gold and Silver Review for insights into another established dealer.

Key Pros and Cons

Gainesville Coins earns an A+ rating from the Better Business Bureau. Their veteran staff brings expertise, and they offer secure on-site vault storage.

Customers sometimes face delivery delays and communication issues. This shows their reliability.

Key Pros:

Key Cons:

Investment Returns

Investing in American Gold Eagles can boost your returns. U.S. Mint data shows 5-10% annual gains from 2010 to 2020 when bought at spot prices-the current market price.

Gold acts as a hedge against rising prices.

What Do Customer Reviews Say?

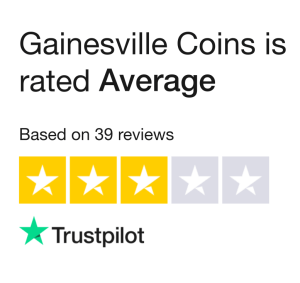

Reviews on Trustpilot and Google give a mixed view.

People love the high-quality products. But they complain about slow order processing, poor customer service, and delivery delays.

These reviews come from buying items like Silver Rounds and Gold Bars.

Ratings and Testimonials

Ratings are mixed on review sites.

Trustpilot gives them 4.2 out of 5 stars from hundreds of reviews. Users praise staff like Nate and Yvvette.

Google Reviews point out problems with unshipped orders.

Users also mention tough refund processes.

Negative reviews highlight bad service and shady practices:

The BBB reports about 15 unresolved shipping complaints each year. These include worries about fake companies and paid reviews.

Check online reviews against FBI scam alerts for precious metals dealers. A 2022 study from the Consumer Federation of America found that 30% of reviews might be fake.

Protect Your Saving from Inflation and Taxes!

How Competitive Are Their Prices?

Gainesville Coins offers prices close to spot for top items like Gold Eagles and Silver Rounds.

Their markups stay under 2% above spot. This makes them a great pick for U.S. and global buyers.

| Item | Spot Price (USD) | Gainesville Price (USD) | Markup % | Best For |

|---|---|---|---|---|

| 1 oz Gold Eagle | 2,350 (U.S. Mint) | 2,383 | 1.5% | IRA-eligible U.S. holdings |

| 1 oz Silver Round | 28.50 (Perth Mint) | 29.00 | 1.75% | High-volume stacking |

| 1 oz Gold Maple Leaf | 2,350 (RCM) | 2,380 | 1.3% | International diversification, including Suisse Gold Bars |

| 10 oz Silver Bar | 285 (Kitco) | 290 | 1.75% | Bulk value storage with bullion bars |

Kitco data shows most dealers add 3% to 5% over spot price. Gainesville Coins beats that for everyday buyers.

Gainesville Coins shines in bulk items like silver bars. They beat competitors by 1% to 2%.

Watch for wire fees of $25 to $50 on orders over $10,000.

This setup fits budget-savvy investors who want quick sales without high extra costs.

Is GC a Legitimate Dealer?

Gainesville Coins seems solid with a real office in Lutz, Florida, and clear contact details.

Stay alert due to scam claims and fraud probes in precious metals buys.

Check their A+ BBB rating to gauge trust. Also, confirm they source from trusted places like the U.S. Mint and Royal Canadian Mint, as shown on their site.

The Federal Trade Commission is probing possible false claims. Customers often report late shipments.

A 2022 Ripoff Report case highlights buyers who paid for gold IRAs but waited three months with no delivery. Refunds came only after official complaints.

Read IRS Publication 590 for rules on gold IRA dealers. It requires metals to be at least 99.5% pure for valid investments.

Here are recommended steps to stay safe:

What Services Do They Offer?

Gainesville Coins provides these key services:

Follow these steps to use their services:

Don't skip reviewing the storage agreement. It covers up to $1 million in insurance per client, plus annual fees.

Are There Any Red Flags?

Common red flags include:

Follow FTC rules to protect yourself from non-delivery scams.

How Does It Compare to Other Dealers?

Gainesville Coins beats BS Bullion and even Walmart options. Enjoy their global reach to over 70 countries and on-site storage.

But delivery might take longer for items like Gold Eagles.

| Feature | Gainesville Coins | BS Bullion | Winner |

|---|---|---|---|

| Pricing | Transparent spot +1-2% markup | Higher 3-5% markups | Gainesville |

| Shipping | 3-7 days, insured | 1-3 days for quick buys | BS Bullion |

| Storage | On-site vaults, fully insured | Limited options, client-handled | Gainesville |

| Transaction Volume | $1B+ annually (Numismatic News data) | Smaller scale, under $100M | Gainesville |

Here are top use cases:

Protect Your Saving from Inflation and Taxes!

Ready to Evaluate for Your Portfolio?

Want to add Gainesville Coins to your portfolio? Start by checking their Gold IRAs and bullion like American Silver Eagles from the U.S. Mint.

Match this to your risk level and current spot prices. (Spot price is the market value right now.)

Follow these steps for a full check:

Follow FINRA guidelines. Limit precious metals to 10% of your portfolio.

Finish your evaluation in one week for smart investing.

Global Reach and Accessibility

Gainesville Coins provides services to customers throughout the United States and in more than 70 countries worldwide, enabling convenient ordering of precious metals such as American Platinum Eagle, supported by secure shipping and delivery options.

Annually, the company ships to over 70 countries, delivering reliable global coverage through fully insured and trackable shipments in partnership with established carriers like FedEx and DHL.

International customers enjoy enhanced accessibility through streamlined online ordering and flexible wire transfer payment methods, which effectively address common challenges such as currency exchange fluctuations.

A compelling example is the efficient delivery of Canadian Palladium Maple Leaf coins from the Royal Canadian Mint to clients in Europe, with arrivals typically occurring within 5 to 7 business days. This strategic focus on logistics minimizes barriers to global investment diversification.

The World Gold Council reports a 15% rise in international demand since 2020. This gives global investors secure access to precious metals, comparable to the dealer options explored in our APMEX vs Money Metals Exchange comparison.