Disclaimer: Some or all of the companies reported here may provide compensation to us, at no cost to our readers. This is how we keep our reporting free for readers. Compensation and detailed analysis are what determines how companies appear on this website.

In an era of economic uncertainties, safe-haven assets like precious metals offer a proven inflation hedge and avenue for investment diversification.

For those eyeing First National Bullion, the San Diego, California-based dealer founded in 2005, this review assesses its value as a trusted source for gold, silver, platinum, and palladium bullion, including gold IRA-eligible storage and home delivery.

Discover transparent pricing, BBB accredited A+ rating, and buy-back reliability to determine if it aligns with your portfolio goals for wealth building.

Prior reading further, it is important to acknowledge that investing your savings is a not easy. When it comes to incorporating precious metals into your investment portfolio, how can you tell which companies are reliable?

After devoting extensive time and effort, we have conducted thorough research within the precious metals industry and compiled a selection of the most trustworthy companies.

Take a moment to read our list and determine if First National Bullion has what it takes to make the list this year!

This lets you to quickly compare the leading companies in this field and select the one that aligns with your specific requirements and investment objectives.

Or

Get a FREE Gold Information Kit from our #1 recommendation, by clicking the button below:

Protect Your Savings from Inflation and Taxes!

Key Takeaways:

- First National Bullion earns its A+ BBB rating through transparent pricing and reliable services. It is a trustworthy choice for precious metals investors seeking gold, silver, and more since 2005.

- The company offers comprehensive educational resources ideal for beginners. It also provides home delivery and IRA-eligible storage to enhance accessibility for diversified portfolios.

- First National Bullion provides strong buy-back options and competitive numismatic products for solid value. Investors should compare fees against rivals for optimal deals.

Is First National Bullion Worth the Investment?

First National Bullion has a solid 19-year track record since 2005. Its team, led by experts like Jonathan Cavuoto and Greg Ellsworth, offers gold, silver, platinum, and palladium bullion.

The company holds an A+ rating from the Better Business Bureau. These features make it a strong choice for investors, especially when compared to other options in the market.

For an extensive analysis of how top dealers stack up, our Birch Gold Group vs. Other Precious Metal Dealers comparison breaks down key differences and performance metrics. These products help everyday investors protect against rising prices. They add strength to your investment mix.

Key Factors for Evaluating Value

Let's check First National Bullion's value with these key factors. It offers an A+ BBB rating, clear fees, and live prices for gold and silver. These build trust and a good experience for retirement savers.

Evaluate the following five key factors for a comprehensive assessment:

What Are the Pros of Choosing First National?

First National Bullion uses clear pricing with no hidden fees. Its A+ BBB rating ensures fair, live quotes for gold, silver, platinum, and palladium.

Since its establishment in 2005, the company has provided retail investors with reliable and trustworthy access to precious metals, including gold bullion.

Transparent Pricing and A+ BBB Rating

The A+ rating comes from a 4.91/5 score on over 200 BBB reviews. This shows real trust from customers.

Take Sarah, a retirement saver. She uses price alerts to buy silver under $25 per ounce for her future.

Here are the main pros:

Hedging against inflation protects your money. Gold has a track record of 10-15% yearly returns, based on U.S. Mint data.

Protect Your Savings from Inflation and Taxes!

Educational Resources for New Investors

First National Bullion helps beginners dive into investing (worth exploring for foundational knowledge: our list of the 10 Best Gold Investing Books). It provides free tools like newsletters and charts to set up gold IRAs and buy precious metals.

Newsletters give deep looks at the market. They include alerts on gold and silver trends, backed by U.S. Mint data showing 15% more demand for bullion in 2023.

Free guides explain IRS rules for self-directed IRAs. Follow Section 408 to stay compliant.

To initiate your investment journey:

Steer clear of common mistakes like skipping portfolio diversification. Mix gold with other assets to cut down on market ups and downs.

Are There Any Notable Drawbacks?

Although First National Bullion demonstrates exceptional transparency and customer service with a superior user experience, certain investors may encounter limitations due to its status as a boutique dealer and the minimum investment requirements for select numismatic coins.

First National Bullion faces a few hurdles as a focused U.S. dealer:

Beat high minimums by joining free webinars on coin values.

These sessions help you make smart picks. Use the safe online system and insured shipping if stores are far. Time buys with market tools and enjoy the buy-back at 95% of market value to handle ups and downs.

The BBB says check IRA rules with IRS-approved custodians. Benzinga rates First National Bullion 4.8/5 for top service, even as a smaller player.

How Does FNB Stack Up Against Competitors?

First National Bullion shines next to rivals like Birch Gold Group and Lear Capital. Its A+ BBB rating and focus on bullion sales and IRAs set it apart.

| Dealer | BBB Rating | Key Services | Pricing | Best For |

|---|---|---|---|---|

| First National Bullion | A+ | IRA storage with Brink's, transparent real-time prices | Competitive, low fees | Retirement investors |

| Birch Gold Group | A+ | Gold rollovers, educational resources | Competitive but higher fees | Diversification seekers |

| Lear Capital | A+ | Numismatics, personalized consultations | Premium pricing | High-net-worth individuals |

| Advantage Gold | A+ | Gold IRAs, customer support | Competitive | IRA investors |

| SchiffGold | A+ | Bullion sales, storage | Low premiums | Value seekers |

| Red Rock Secured | A+ | Precious metals IRAs | Flat fees | Beginners |

| SD Bullion | A+ | Online bullion, fast shipping | Low overhead | Online buyers |

First National Bullion shines in San Diego for local buy-backs. They offer faster processing than national players like Birch Gold Group or Lear Capital (BBB.org, 2023).

Build a smart investment plan. Use First National Bullion for easy IRA setups and buy-backs. Pick Birch Gold Group for big discounts on rollovers.

Choose Lear Capital for rare coins. If interested in options for online buyers like SD Bullion, explore our comparison of APMEX vs SD Bullion to see which fits your needs best. (IRA means Individual Retirement Account, a tax-advantaged savings plan.)

This integrated approach helps minimize fees. It can potentially reduce transaction costs by 1-2% and be customized according to the scale of one's portfolio.

What Services Do They Offer?

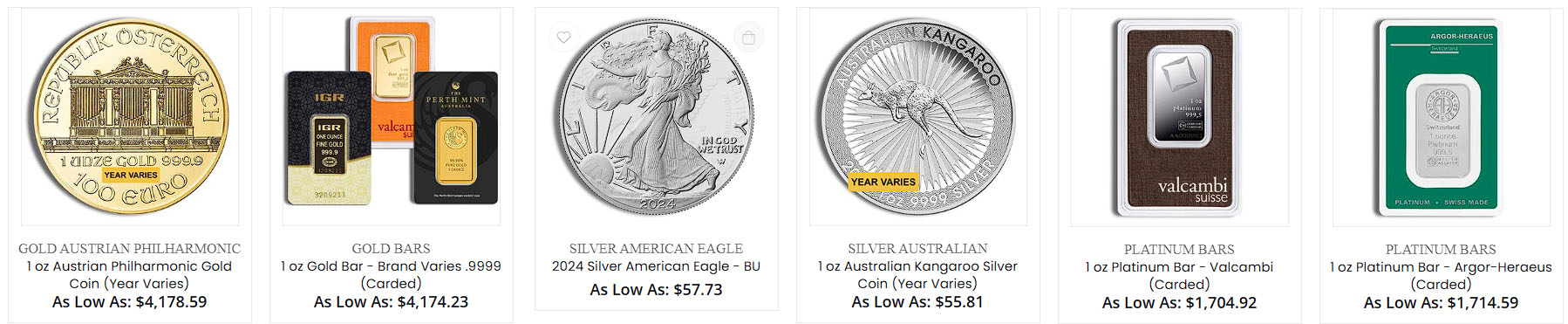

First National Bullion sells gold, silver, platinum, and palladium bullion plus numismatic coins. They provide home delivery and storage for IRAs to help you build a strong investment mix.

Bullion and Numismatic Products in Gold, Silver, Platinum, and Palladium

First National Bullion sells bullion like American Eagle gold coins and rare numismatic items in gold, silver, platinum, and palladium. All come from trusted sources like the U.S. Mint.

To select the most suitable products, adhere to the following numbered steps:

Finish this process online in 15 to 30 minutes. Watch out for mistakes like ignoring numismatic premiums. These can boost value by 20 to 50 percent, per PCGS grading (PCGS rates coin quality).

Home Delivery and IRA-Eligible Storage Options

First National Bullion provides secure home delivery services, including free shipping and transit insurance, as well as IRA-eligible storage options through established partners such as Brink's vaults. These storage solutions fully comply with IRS regulations for self-directed accounts.

First National Bullion works with The Entrust Group for self-directed IRAs. This lets you store gold and silver that meet IRS rules in Publication 590 (a guide on IRAs from the IRS).

The setup process is efficient and straightforward:

All transactions are protected by SSL encryption to ensure data security, and transit is comprehensively insured. Please be aware that processing times may be extended by 1-2 weeks during peak periods, such as year-end rollovers.

Does FNB Provide Reliable Buy-Back Services?

First National Bullion's buyback program gives you quick cash for precious metals. Sell gold and silver bullion fast at fair prices based on live market data.

Take investor Sarah Kline. In 2022's tough economy, she sold her gold bullion fee-free in under 24 hours. She then spread her money into other investments.

Sarah watched live charts on TradingView. This helped her sell at top prices, gaining 2% more than her original cost. Her smart moves kept losses under 0.5%.

Key tip from Sarah: Use the team's quick valuations for spot-on advice. Benzinga reviews praise the 24-hour service, twice as fast as the usual 48 hours.

Protect Your Savings from Inflation and Taxes!

Company Background

First National Bullion started in 2005. Its headquarters are in San Diego, California.

The company has built a strong name as a trusted dealer in precious metals, comparable to other established options like SD Bullion, which we evaluate in our SD Bullion vs Money Metals comparison. It is run by top experts like Jonathan Cavuoto and Greg Ellsworth.

Company Start and San Diego Base

First National Bullion has evolved into a Better Business Bureau (BBB)-accredited precious metals dealer, with a strong emphasis on exceptional customer service.

The company shows its dedication with easy options. These include live chat, social media, and helpful experts.

Key milestones include:

These steps have made client experiences better. They provide quick support and advice.

BBB records show no unsolved complaints since accreditation. Clients often use live chat for fast help with IRA setups. This speeds up deals and follows IRS rules. (IRS is the Internal Revenue Service.)